Brazilian iron ore miner Vale SA (VALE) has still not complied with commitments signed with authorities to prevent a mining disaster, federal prosecutor Edison Vitorelli told Reuters.

That’s despite two major deadly mining disasters in the last five years, including the collapse of the Brumadinho dam in January 2019 that killed 270 people.

“If only these events were isolated, but they are not. All the 29 dams are problematic and Vale has been disobeying the agreements to this date,” Vitorelli told Reuters.

“It’s not lack time or money to meet the requirements. It’s five years since the first disaster. The problem is the company’s culture,” he continued.

Some of the mines linked to the dams regarded as unsafe are critical to Vale’s plans to recover lost iron ore production and grow capacity to 450 million tonnes per year, says Reuters.

Vale denied the allegations, telling Reuters that it is on track to meet all its commitments and promptly addresses risks.

“The company awaits external complaints before reacting, and this is systemic,” Vitorelli added.

A recently-released United Nations report also stated that Vale’s restoration projects, which began in 2015, are still behind schedule.

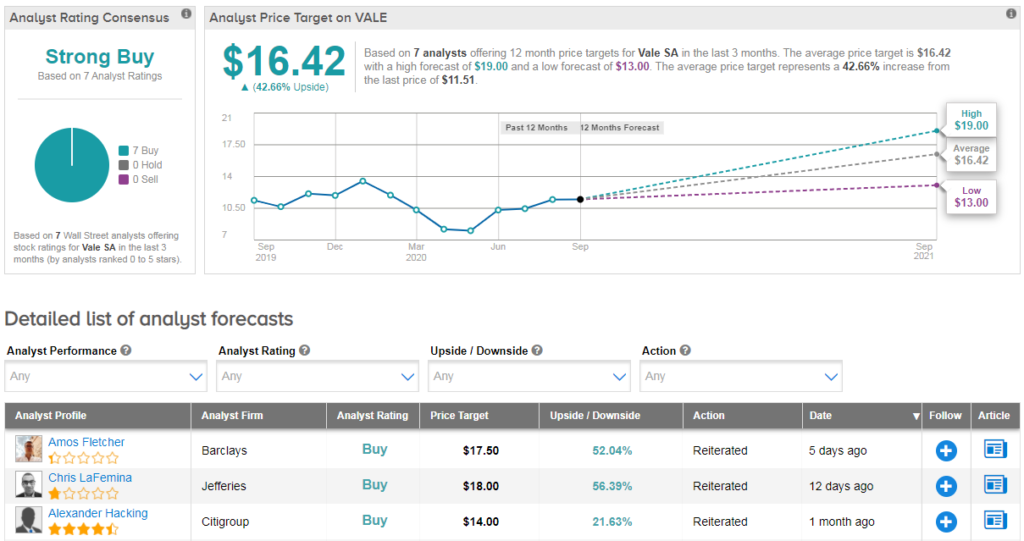

Shares in Vale are down 13% year-to-date, but the stock scores a bullish Strong Buy Street consensus. Meanwhile the $16 average analyst price target indicates significant upside potential from current levels.

“VALE screens inexpensive at 2.3x our base case 2021E EV/EBITDA. Further cash returns into what remains a robust iron ore market should catalyse a re-rating” comments RBC Capital analyst Tyler Broda.

He has a buy rating on the Vale with a $19 price target, explaining that management recently reiterated that expected final liabilities from Brumadinho are sufficiently covered by the current provisioning.

However he noted that a final agreement may now take some time to be agreed with some prosecutors taking a harder line than the state and courts which have largely agreed.

“This agreement takes less precedence for the investment case in our view now that VALE has restarted its dividend payments” Broda argued. (See VALE stock analysis on TipRanks)

Related News:

Delta Upsizes Loyalty Program-Backed Debt Deal To $9B

US Steel Up 5% As 3Q Outlook Reflects Improved Business

Barrick Gold Accepts Chilean Court Ruling On Pascua-Lama Project