BP PLC flipped to a $5.7 billion loss in 2020 from a $10 billion profit in the year-ago period, as lower energy prices, significant exploration write-offs, and depressed demand all dented its performance during the coronavirus pandemic. Shares declined 4.4% in Tuesday’s pre-market trading session.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Analysts had been looking for a full-year 2020 loss of $4.8 billion. BP (BP) reported that performance was significantly impacted by lower marketing performance in the downstream segment, with volumes, refining margins and utilization still under pressure due to COVID-19.

In the fourth-quarter, BP’s adjusted net income plunged to $115 million from $2.57 billion during the same period a year ago. Analysts had expected the oil major to post $286 million in adjusted net income. Operating cash flow for the quarter, excluding Gulf of Mexico oil spill payments of $0.1 billion, was $2.4 billion. BP announced a 5.25 cents per share dividend for the quarter.

“2020 will forever be remembered. Our sector was hit hard as well. Road and air travel are down, as are oil demand, prices and margins,” commented BP CEO Bernard Looney. “We launched a net zero ambition, set a new strategy to become an integrated energy company and created an offshore wind business in the US. We began reinventing bp – with nearly 10 thousand people leaving the company. We strengthened our finances – taking out costs and closing major divestments. We expect much better days ahead for all of us in 2021.”

Net debt, which stood at $39 billion at the end of 2020, declined by $1.4 billion over the fourth quarter and $6.5 billion throughout last year. The oil giant targets a net debt level of $35 billion between the fourth quarter of this year and first quarter of 2022, which will trigger the start of share buybacks. This assumes oil prices are in the range of $45-50 a barrel. In addition, BP expects proceeds from divestments and other disposals to amount to $4 billion-6 billion in 2021.

Shares in BP have seen some recovery, with a 38% gain over the past three months after losing 37% of their value over the past year as the coronavirus pandemic pushed oil prices to multi-year lows, leading to declines in oil and gas output. (See BP stock analysis on TipRanks)

Ahead of the earnings results, MKM Partners analyst John Gerdes this month initiated the stock’s coverage with a Buy rating and a $31 price target. Gerdes expects BP to generate $26 billion of free cash flow during 2021-2025.

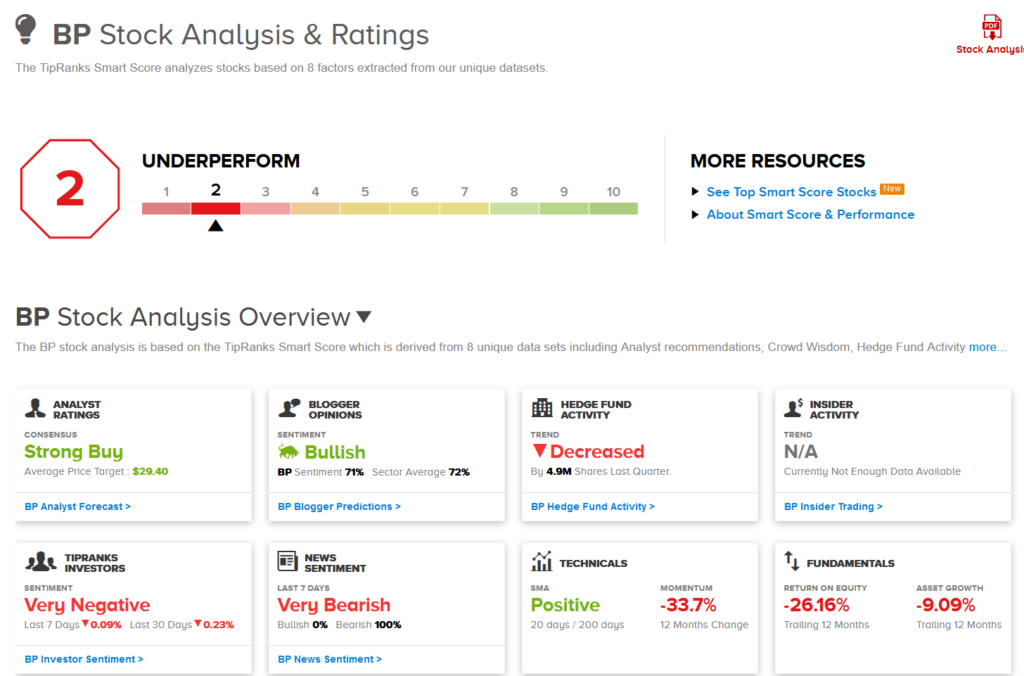

The rest of the Street has a bullish outlook on the stock, with a Strong Buy consensus rating based on 4 Buy ratings versus only 1 Hold rating. What’s more, the average analyst price target of $29.40 implies upside potential of about 32% over the coming 12 months.

Meanwhile, on TipRanks’ Smart Score system, BP gets a 2 out of 10, indicating that the stock is likely to underperform market expectations.

Related News:

BP Sells $2.6B Oman Gas Block Stake To Thailand’s PTT

Virgin Galactic Shares Pop 14% Pre-Market After Flight Test Program Update

XPeng’s EV Deliveries Pop 470% In January; Shares Surge 6% Pre-Market