Shares of Box dropped 5.9% in Tuesday’s extended trading session after the company’s 4Q sales outlook fell short of analysts’ expectations. The cloud storage company projects 4Q revenues between $196 million and $197 million, which lagged the Street’s estimates of $198.7 million. Meanwhile, its adjusted EPS forecast of $0.16-$0.18 topped Wall Street’s projection of $0.15.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

For 3Q, Box (BOX) reported better-than-expected results. Sales increased 11% to $196 million year-on-year and beat the Street consensus of $194 million. Adjusted EPS of $0.20 came ahead of analysts’ expectations of $0.14 and compared to the year-ago quarter’s loss per share of $0.01.

“Our cloud content management product suite continues to gain momentum as more enterprises prioritize digital transformation and building around best-of-breed applications,” said Aaron Levie, CEO of Box. “In the quarter, we closed strategic deals with leading organizations, including USAA, Murata Manufacturing and the U.S. Air Force, and growing demand for products like Shield and Relay continue to accelerate adoption of our bundled Suite offerings.” (See BOX stock analysis on TipRanks)

For fiscal 2021, Box now projects revenues in the range of $768-$769 million, compared to $767-$770 million forecasted previously. The company raised its adjusted EPS guidance range to $0.64-$0.66 from the earlier projection of $0.56-$0.60.

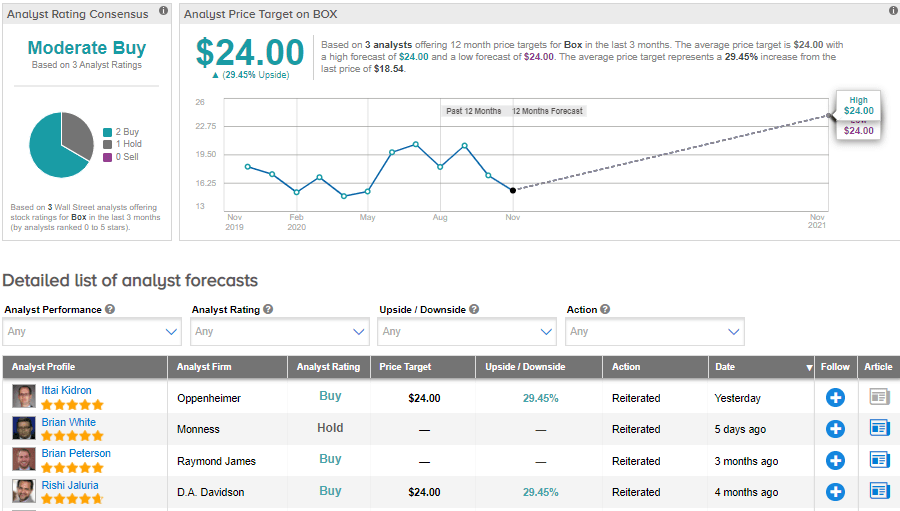

Following the earnings release, Oppenheimer analyst Ittai Kidron reiterated a Buy rating and price target of $24 (29.5% upside potential) on the stock. In a note to investors, Kidron wrote, “we remain positive on Box’s prospects believing the company can improve retention rates, see a rise in large deal count, and continue with its planned margin expansion despite a NT (near-term) COVID-19 drag.”

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 2 Buys and 1 Hold. The average price target stands at $24 and implies upside potential of about 29.5% to current levels. Shares have advanced by about 10.5% year-to-date.

Related News:

Zoom’s 3Q Profit Blows Past Estimates; Stock Drops 5%

AMD Jumps 6% As CEO Sees PC Growth In 2021; Stock Up 102% YTD

BAE Systems Nabs $3.2B UK Armed Forces Contract; Street Is Bullish