Canadian aircraft maker Bombardier (TSE:BBD.B) recently missed out on a military contract after the Canadian government turned to Boeing (NYSE:BA) for a new set of planes. Bombardier could have contested the move but plans to leave the matter alone. Ceding the field to Boeing may not sound like a great plan, but investors are eating it up, and shares are up over 3.5% on the news.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The Canadian government recently turned to Boeing for a line of patrol planes, which sent Boeing shares up wonderfully at the time. Though some might have wondered why the Canadian government turned to foreign sources rather than its own backyard, the move didn’t faze Bombardier much. The biggest reason, essentially, is that Bombardier couldn’t have won the business anyway. Canadian Defense Minister Bill Blair noted that the Boeing craft were the only ones that could carry anti-ship missiles and offer submarine-detection systems. Bombardier did have an alternative craft in mind, but that won’t actually be produced until sometime after 2030. Thus, for at least the next six years, Bombardier will continue to concede the field.

Bombardier Has Other Plans

Losing that kind of business isn’t good news, but Bombardier has other plans. It’s investing heavily in what’s called “deep sensing,” reports note, which is an ability to better see into enemy territory and better direct fire. It’s also looking to branch out and invest more heavily in its plant in Wichita, Kansas. Further, Bombardier reportedly wants to look more into “reusable solutions,” a plan that’s likely to catch some interest.

Is Bombardier Stock a Good Buy?

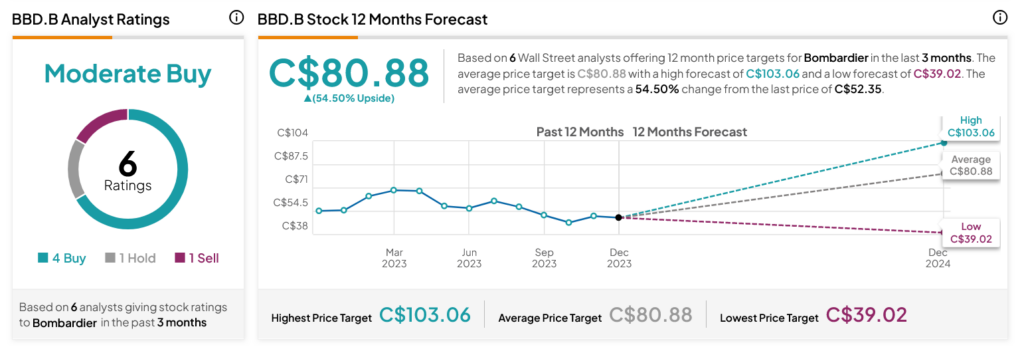

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSE:BBD.B stock based on four Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. After a 5.56% loss in its share price over the past year, the average TSE:BBD.B price target of C$80.88 per share implies 54.5% upside potential.