And so, the saga of Starliner, from beleaguered aerospace firm Boeing (BA), is about to at least start its end tomorrow. The ship will attempt to return to Earth, completely empty, on Friday, and investors responded accordingly, giving up themselves by selling off Boeing shares in Thursday afternoon’s trading.

Starliner will attempt to undock from the International Space Station and come home, aiming for a landing site in New Mexico’s White Sands Space Harbor, noted NASA. This assumes, of course, that weather forecasts remain clear.

Starliner is expected to take about six hours to come back home, and there is a distinct possibility that something could go wrong, which is why the astronauts will not be aboard. NASA is looking forward to getting Starliner back home, even if the astronauts aboard will now be required to remain at the International Space Station until February of 2025 when a SpaceX flight is expected to go up and get the duo.

Business Changes

Meanwhile, Boeing has troubles enough closer to Earth. Two days ago, we heard about an analyst downgrade, thanks largely to issues of cash flow at Boeing. With debt of around $57.9 billion and cash and securities of about $12.6 billion, this might seem like a concern. But reports also suggest that Boeing will be paying down quite a bit of debt, which may make cash flow concerns a bit premature.

Further, some are looking for another cost-saving measure to kick in: the shutdown of Boeing Global Services. The original launch of Global Services was to improve revenue production in the service sector, like parts distribution, training, and similar matters. Despite being a lucrative segment—it brought in $3.3 billion in profit on $19 billion in revenue—some think it is time to get back to basics. With Boeing not a service company, providing services would seem like a non-core business and, potentially, a good place to cut.

Is Boeing a Buy, Sell, or Hold?

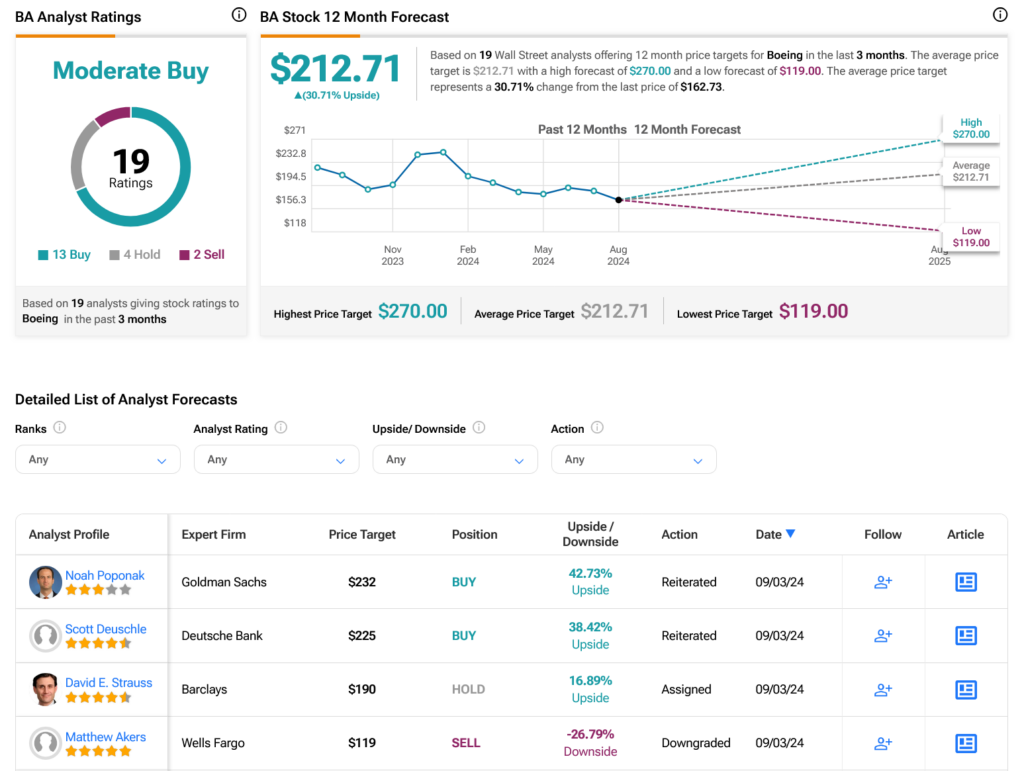

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 13 Buys, four Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 25.33% loss in its share price over the past year, the average BA price target of $212.71 per share implies 30.71% upside potential.