Boeing Co.’s (BA) aircraft deliveries continued to decline in May, while order cancellations increased as travel restrictions tied to the coronavirus pandemic have throttled commercial jet demand.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Last month, the ailing plane maker delivered 4 planes, compared with 6 in April, adding up to a total of 58 in the first five months of this year, as air travel demand has been halted in an effort to contain the coronavirus pandemic. The report comes after France-based planemaker Airbus SE (EADSF) said earlier this week that it did not receive a single order in May.

Boeing reported order cancellations of another 18 planes last month, including 14 of its 737 MAX jets. Last year, the U.S. planemaker suspended production of the MAX jets following a second crash. It recently resumed production of the jets at its factory in Renton, Washington, albeit at a low rate.

Against this, Boeing did get 9 new orders for wide body planes, which included two 777 freighters, one 737 NG and one 767 freighter.

The coronavirus travel restrictions have resulted in a deep cut in the number of commercial jets and services Boeing customers need over the next few years. As such, global airlines suffering billions of dollars in losses have been seeking to cancel or delay some of the orders they have with Boeing. COVID-19 has hit the planemaker very hard, with shares still down 35% since the beginning of the year.

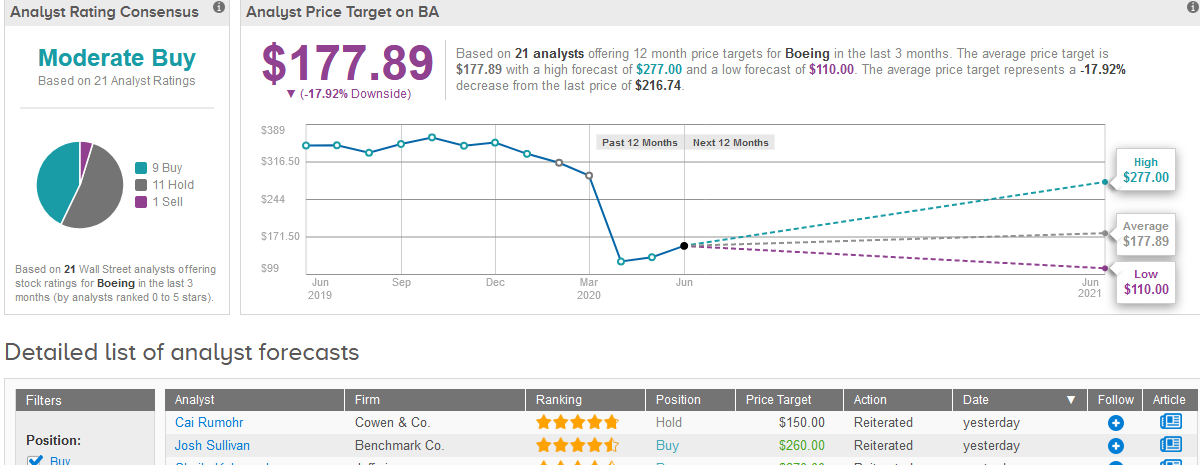

The stock dropped 6% to $216.74 on Tuesday. Commenting on the report, five-star analyst Cai Rumohr at Cowen & Co, said that he attributed the “very weak” deliveries in May to COVID-19 shutdowns and flight restrictions. Rumohr reiterated his Hold rating on the stock with a $150 price target.

Looking ahead to Q2, Rumohr sees “headwinds of sharply lower commercial delivery/service sales than in Q1, continuing abnormal production/severance expense, and possible further MAX compensation reserves”. The analyst estimates that Q2 cash outflow could hit $9 billion with a resumption of a dividend unlikely until 2024.

Wall Street analysts are cautiously optimistic on the stock. Nine Buys, 11 Holds, and 1 Sell rating give Boeing a Moderate Buy analyst consensus, with the $177.89 average analyst price target reflecting 18% downside potential in the shares over the coming year. (See Boeing stock analysis on TipRanks).

Related News:

Airbus Gets No New Aircraft Orders In May Amid Aviation Crisis

Boeing CEO Says ‘Likely’ A Major Airline Could Fold In 2020

Colombian Carrier Avianca Files for Bankruptcy Protection Due to Coronavirus Woes