Global aerospace company Boeing (NYSE: BA) recently revealed that it has increased its presence in Japan by opening a new Boeing Research and Technology (BR&T) center. Shares of the company reacted positively to the news as it gained 6.1% to close at $169.07 in the normal trading hours.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The New Center Will Focus on Clean Energy

Boeing’s new center will support an expanded cooperation agreement with Japan’s Ministry of Economy, Trade and Industry (METI). This expanded agreement follows the company’s earlier 2019 Cooperation Agreement with METI.

The core focus of the expanded agreement will be on sustainable aviation fuels (SAF), electric and hydrogen powertrain technologies, and future flight concepts that will promote zero climate impact aviation.

Additionally, the partnership will focus on exploring electric and hybrid-electric propulsion, batteries, and composite manufacturing. This is expected to give urban mobility a facelift.

Notably, the new facility will be located in Nagoya. The place is familiar to Boeing as many of its major industrial partners and suppliers are located here.

Boeing Gets Temporary Relief From Workers’ Strike

Meanwhile, Boeing temporarily avoided a strike at its three St. Louis-area plants that make weapons and military aircraft. The dispute has primarily been regarding retirement benefits for the St. Louis-area workers.

Notably, the proposed three-year contract from the corporation includes an $8,000 lump-sum payout for new employees. Additionally, earlier plans to reduce employer contributions to 401(k) savings plans for employees have been shelved. However, a strike could start Thursday if employees reject the proposal.

Wall Street’s Take

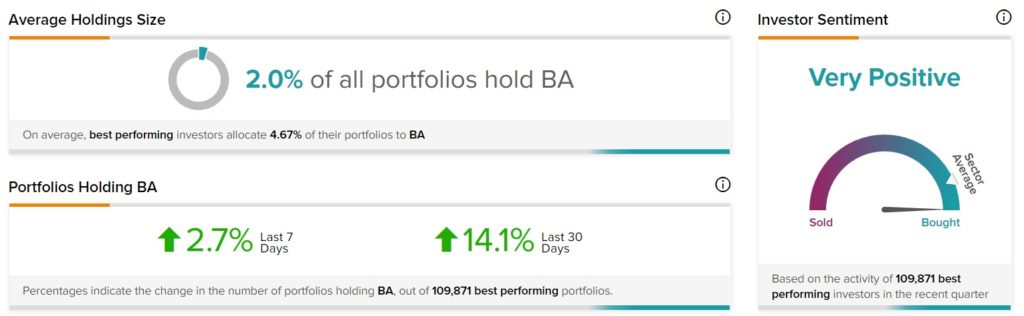

Overall, consensus among analysts for Boeing stock is a Strong Buy based on 11 Buys and three Holds. The BA average price target of $209.23 implies upside potential of 23.8% from current levels. Further, the top investors also have a Very Positive stance on BA. About 14.1% of the top portfolios tracked by TipRanks, increased their exposure to BA stock over the past 30 days.

Final Thoughts

Boeing’s move to expand its presence in Japan and increase capabilities in the sustainable fuel segment is expected to hold the company in good stead. Moreover, by temporarily averting a strike in its production facilities, Boeing has ensured the smooth conduct of operations.

However, the company’s widening losses and declining revenues as reported in its recent quarterly results remain concerns for the company.

Read full Disclosure