Remember when aerospace company Boeing (BA) made its “best and final offer” to employees, which was then rebuffed, and replaced by two more final offers? Well, reports suggest that this might actually be the real final offer from management.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

According to several media reports, Boeing really means it when it says the most recent proposal is its “best and final offer.” The report noted that Boeing CEO Kelly Ortberg himself made it clear to employees that the next offer from the company will be regressive.

The newest offer being voted on includes a 38% wage increase over the next four years, which is just shy of the 40% the union was demanding. However, hopes for a return of a Boeing pension remain off the table.

Union and Management in Agreement?

Interestingly, this time around, the union is not sticking to its guns, but rather urging a reconciliation with Boeing and telling the striking machinists that it is time to take the deal and get back to work. The union has reportedly told employees that this really likely would be Boeing’s best deal. A statement from the union declared, “In every negotiation and strike, there is a point where we have extracted everything that we can in bargaining and by withholding our labor. We are at that point now and risk a regressive or lesser offer in the future.”

Given that Boeing recently raised around $20 billion through a stock sale to bolster its finances, workers should assume Boeing means business. But considering that the offer is at least within striking distance of what workers wanted, they may be more willing to cut their losses.

Is Boeing a Good Stock to Buy?

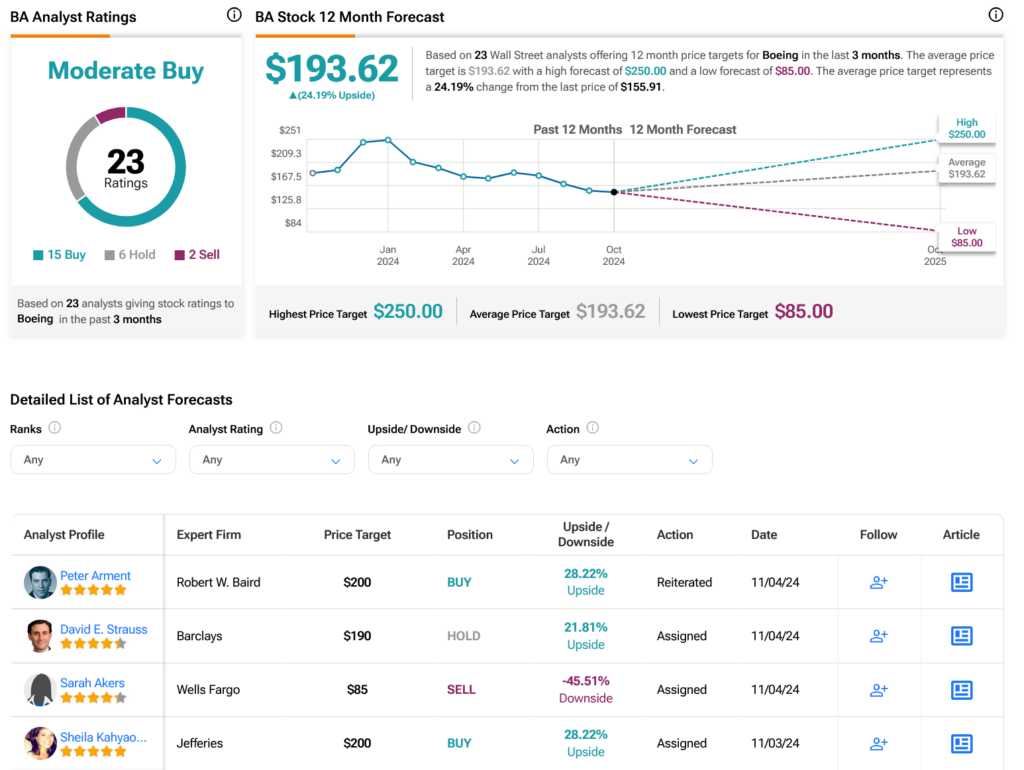

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 15 Buys, six Holds and two Sells assigned in the past three months, as indicated by the graphic below. After a 19.16% loss in its share price over the past year, the average BA price target of $193.62 per share implies 24.19% upside potential.