It could be forgiven if you’re wondering what in the world aircraft maker Boeing (NYSE:BA) is doing now. After all, it’s on the ropes, suffering from production limits and near-constant supervision from the Federal Aviation Administration. But it’s actually down nearly 1.5% in Friday afternoon’s trading for a completely different reason: it’s reportedly looking to acquire one of its biggest suppliers outright – Spirit AeroSystems (NYSE:SPR).

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Reports note that Spirit has already hired some bankers to start “explor(ing) alternatives,” a process which generally includes the notion of an outright sale of the business. Separate reports, meanwhile, noted Boeing’s interest in buying the supplier. However, there are reports that note Spirit is looking to sell some of its Irish operations to Airbus (OTHEROTC:EADSY), so the Spirit sale may ultimately not be a complete sale. This is something of a pivot for Boeing, as back in June, it noted that it wasn’t particularly interested in buying Spirit.

Then The FAA Hit

The FAA just dropped a hammer on Boeing, as it now has 90 days to introduce a plan to address the “serious quality and safety issues” found within the company. An FAA probe that ran the better part of a year revealed that there was a substantial “disconnect” between Boeing executives and employees over safety issues. Further, Boeing’s reported treatment of whistleblowers didn’t endear it to the watchdog agency.

What Is the Prediction for Boeing Stock?

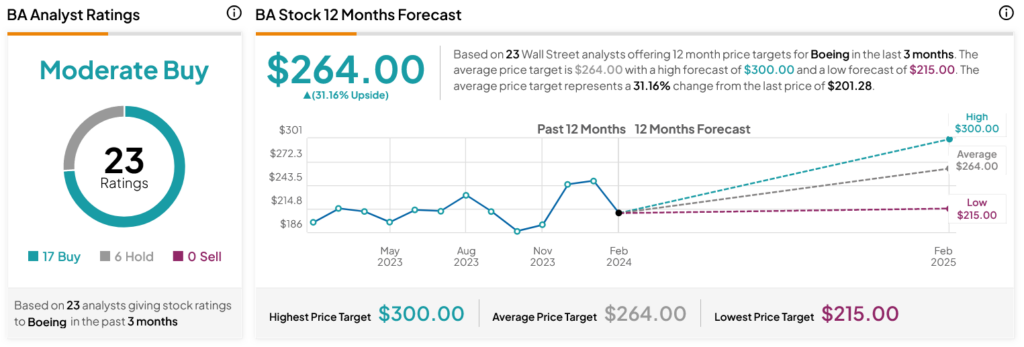

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 17 Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 4.29% loss in its share price over the past year, the average BA price target of $264 per share implies 31.16% upside potential.