Airplane maker Boeing (NYSE:BA) is nearing a new “high double-digit” order for its 777X jets from Emirates at the Dubai Air Show that is starting on Monday, Bloomberg reported. This deal would be in addition to Emirates’ existing order backlog for 115 777X widebody aircraft. Separately, in another favorable development, Bloomberg reported that China could end its freeze on Boeing when the Chinese and U.S. presidents meet this week at the APEC summit.

Boeing-Emirates Deal

As part of this new deal, Emirates’ regional affiliate FlyDubai is also expected to place some orders for the smaller 787 Dreamliner. Emirates is already the biggest buyer of Boeing’s 777X jets. If the new deal goes through, it could boost the prospects of the much-delayed 777X program. Deliveries of the 777X jets are currently expected to begin in 2025 following a five-year delay.

Emirates is also in talks with Boeing’s rival Airbus (EASDF) about an order to purchase A350 aircraft. The Dubai Air Show is expected to witness many other major deals, as several carriers intend to upgrade their fleets.

China Mulls Ending Freeze

China is considering ending its freeze on Boeing when the country’s President Xi Jinping meets U.S. President Joe Biden this week at the APEC summit. While a formal order for the 737 jetliner might not be announced by the Chinese president, commitments in the form of a memorandum of understanding or a letter of intent could be signed at the event.

Two fatal crashes led to the global grounding of the 737 Max model. Moreover, escalating tensions between the U.S. and China halted Boeing’s business in the key international market.

Boeing recently projected that China would constitute 20% of the global aircraft demand over the next two decades. Given such significant growth opportunities, the removal of the freeze is expected to boost the prospects for Boeing’s 737 Max jets and enhance the company’s overall revenue.

Is Boeing a Good Stock to Buy Right Now?

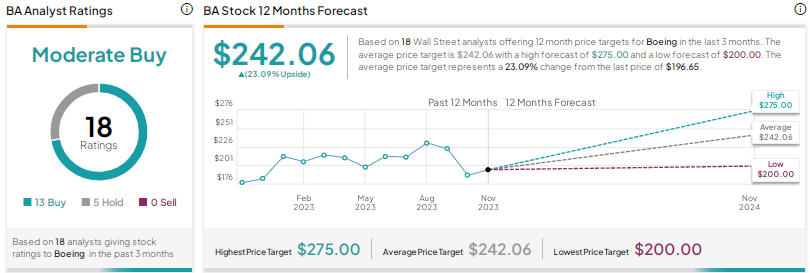

Earlier this month, Goldman Sachs analyst Noah Poponak revised his rating for Boeing stock to Buy from “Conviction Buy” with a price target of $258.

The analyst thinks that investors are more focused on near-term headwinds than long-term fundamentals and normalized free cash flow of Boeing, creating a buying opportunity in this “domestic half of the global aircraft manufacturing duopoly (Airbus is the Europe-based competitor).”

With 13 Buys and five Holds, Wall Street has a Moderate Buy consensus rating on Boeing stock. The average price target of $242.06 implies 23.1% upside potential. Shares are essentially flat on a year-to-date basis.