Give aerospace stock Boeing (BA) credit for moving fast. Just yesterday, we heard about its key supplier, Spirit AeroSystems (SPR), being considered for a bailout move that will help keep it afloat until the merger, which is expected to hit in 2025. Now, we have more specifics on that move, including a dollar amount. But investors were not happy, and shares slid over 2% on the news.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

A report from Bloomberg spelled it out: $350 million for Spirit. It is being offered in the form of an advance against future payments, the report noted, and will be used to “…support production and readiness to make Boeing aircraft at the rates required by the U.S. planemaker.” This is not the first time that Boeing has added cash to Spirit’s coffers; back in April, Boeing put up $425 million in cash to help keep Spirit up and running.

Spirit was suffering as Boeing slowed its pace down substantially, first due to issues of 737 Max fuselages that needed work in Boeing factories, then the outright strike that all but shuttered production for seven weeks. Thus, Spirit noted it would likely burn through as much as $500 million from this year’s fourth quarter through to the merger date. The extra $350 million, therefore, might be enough, especially now that Boeing is back to work.

New Orders and Roster Changes

Boeing is getting back to work, but not all of Boeing will be. 33-year veteran Elizabeth Lund, who most recently served as the top executive for quality at Boeing, announced her retirement despite being in the role for less than a year. Lund had planned to retire earlier, a Wall Street Journal report noted, but she was asked to stay on long enough to finish up a “safety and quality plan” for the Federal Aviation Administration.

Separately, on a more positive note, Avia Solutions Group announced it would buy 40 737 Max 8 planes and has the option to order 40 more. Avia is the world’s largest provider of “aircraft, crew, maintenance and insurance” (ACMI), and the planes will be used as part of several airlines’ operations, noted a KSN report.

Is Boeing a Good Stock to Buy Right Now?

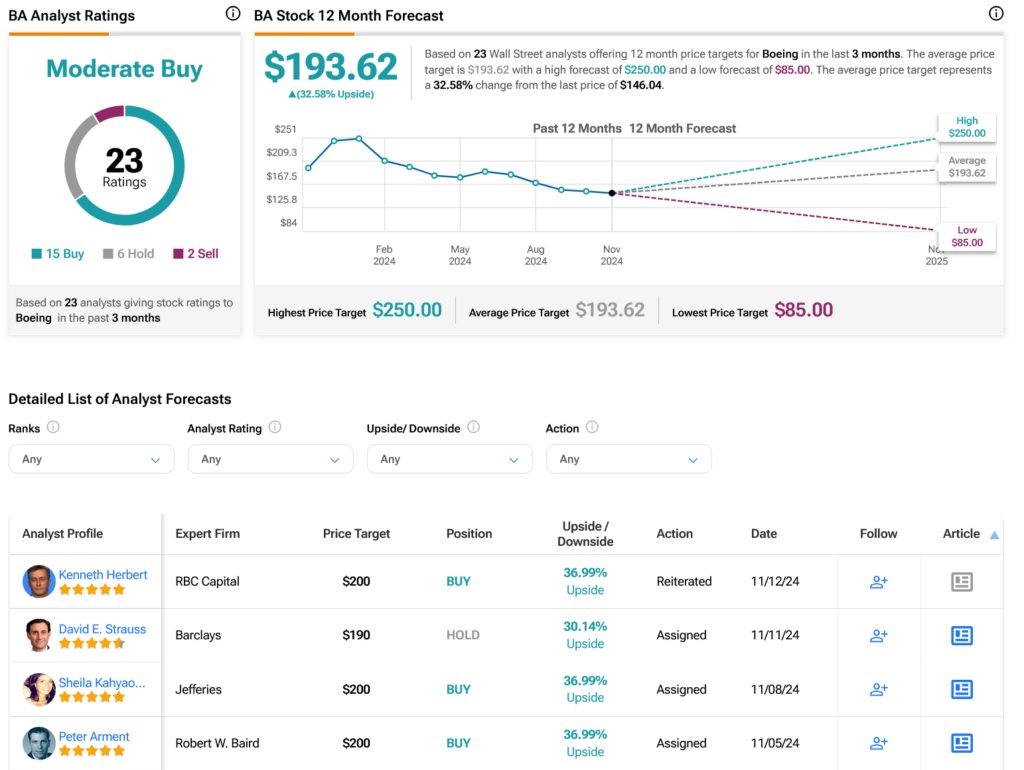

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 15 Buys, six Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 28.6% loss in its share price over the past year, the average BA price target of $193.62 per share implies 32.58% upside potential.