Yesterday, we got word that aerospace company Boeing (BA) was facing some potential labor trouble, with the International Association of Machinists and Aerospace Workers District 751 union looking into a strike authorization ahead of the first full negotiation in years. But now, that potential got a lot closer to reality, as the authorization has been granted. Boeing shares lost over 2% in Thursday afternoon’s trading.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Reports noted that the strike authorization vote went through with 99.9% in favor. Although union officials noted they didn’t want a strike, they’re prepared to do it. Regardless of the union’s stance, there won’t be any risk of strike until at least September 12, when the current contract expires. That should give Boeing more time to work with and potentially build some inventory.

The union is seeking a 40% pay hike and wants its traditional pension program back. It also wants assurances that the next new airplane will be a Washington state product, as opposed to getting moved to some other country with lower-cost workers.

A Path to Victory for Boeing

Meanwhile, CNBC took on the notion of Boeing’s path to victory and whether it can recover from weeks of disaster, much as we did several weeks ago. CNBC’s report addresses many of the same points we did, looking at Boeing’s current management and suggesting a path that should at least get the company back to glory. This includes better training and manufacturing processes, as well as buying back its key supplier, Spirit AeroSystems.

However, they also raise a lot of the same drawbacks we did, starting with perceptions about Boeing’s management—the same people in charge during the decline are, mostly, still in charge today—along with Boeing’s declining cash flow thanks to the government-mandated production cap. There is a chance for a comeback at Boeing, but not without a lot of trouble and hard work.

Is Boeing Stock a Buy, Sell, or Hold?

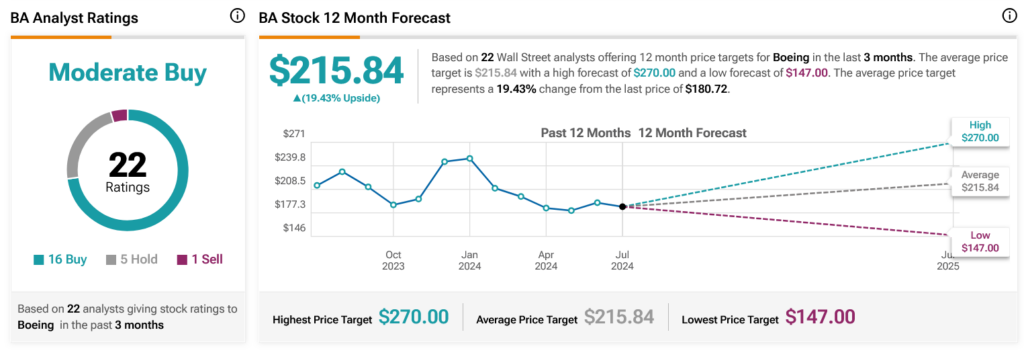

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 16 Buys, five Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 13.41% loss in its share price over the past year, the average BA price target of $215.84 per share implies 19.43% upside potential.