Beleaguered aerospace stock Boeing (BA) has faced its share of troubles over the last few months; just go through our archives and see for yourself. Now, another problem has reared its ugly head as Boeing faces concerns about its credit. The market shrugged off this issue, though, and Boeing shares were up over 1.5% in Tuesday afternoon’s trading.

The newest problem for Boeing to tackle is one of creditworthiness. Currently, Boeing’s bond rating is sitting at BBB, which is basically the last step before you fall off the ladder altogether. With Boeing’s debt now inches from junk bond territory—and a huge new set of problems that comes with that—it is not surprising that Boeing is looking to perk up its credit rating.

But with S&P Global cutting its rating from Neutral to Negative back in spring, it is clear that many ratings agencies are not exactly liking what they are seeing from Boeing. And a cut to junk status will end up costing Boeing big time when it comes to issuing new debt, as investors will demand higher interest rates in order to compensate for the higher risk.

Boeing’s big problem right now is declining cash flow. It can only fill so many orders with a federal production cap still in place, and that puts a ceiling on how much cash can come in.

Sales Still Brisk, However

It is worth pointing out here, though, that sales are still brisk for Boeing. Airlines are still making orders, even for aircraft that will not be delivered for years. It helps that Boeing is part of an effective duopoly with Airbus (EADSY), which makes the number of sources for new aircraft inherently limited.

In fact, Boeing received 72 orders for new planes in July, ahead of Airbus’ 59 orders. This does not happen often, reports noted, but the Farnborough Air Show delivered a lot of interest Boeing’s way. However, with Boeing having lost its ability to produce, and the fact that it does not get paid until a plane is delivered, that still leaves it in a financially troubling situation.

Is Boeing a Buy, Sell, or Hold?

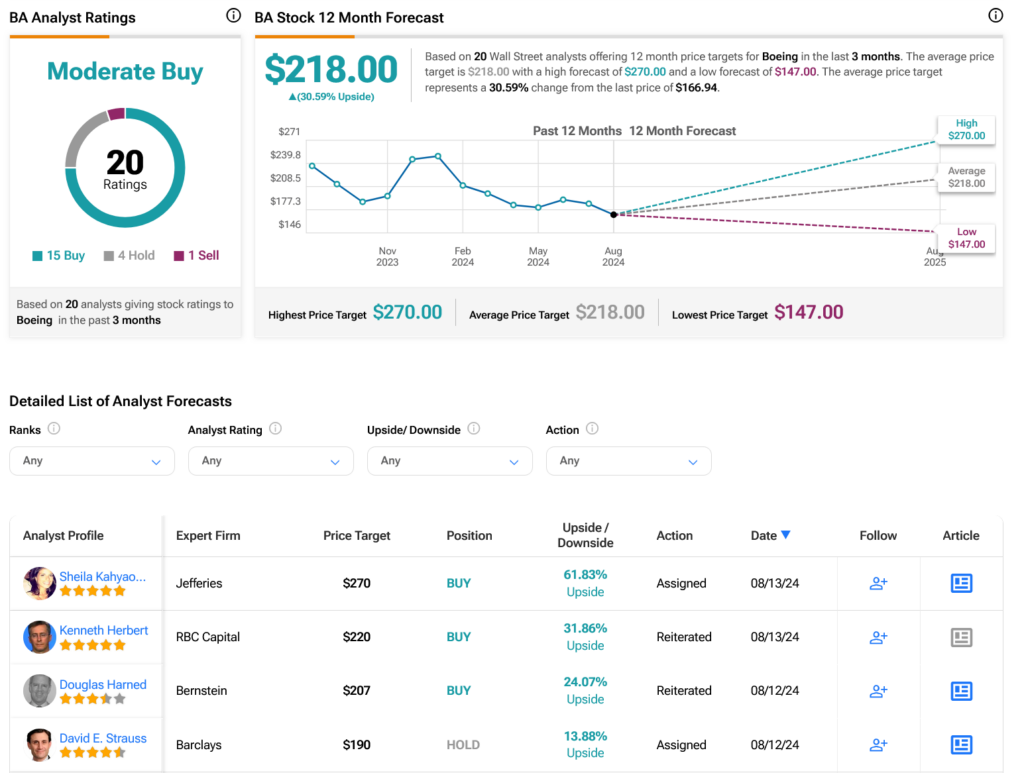

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 15 Buys, four Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 29.47% loss in its share price over the past year, the average BA price target of $218 per share implies 30.59% upside potential.