It appears that Boeing (NYSE:BA) could face new legal troubles, potentially further affecting its bottom line, due to a series of aircraft accidents and the subsequent investigations. Reports suggest that the U.S. Justice Department is planning to bring criminal charges against the aerospace company specifically related to fraud connected to two previous fatal crashes. Moreover, there are indications that the Justice Department has a plea agreement ready for Boeing.

The agreement includes a penalty of $487.2 million, with half of this amount credited from a previous settlement, up to three years of probation, and three years of oversight by an independent monitor for safety and compliance.

What Could a Criminal Conviction Mean for Boeing?

A criminal conviction would be devastating for Boeing. According to a Bloomberg report, citing defense attorney Eddie Jauregui, criminal convictions can prevent a company from contracting with the federal government and hinder its ability to secure loans. This is significant for Boeing, as the federal government is the company’s largest customer and the nation’s top exporter.

In FY23, 37% of Boeing’s revenues came from U.S. government contracts, including Foreign Military Sales (FMS). FMS is a U.S. government program that helps foreign governments purchase American weapons and defense equipment.

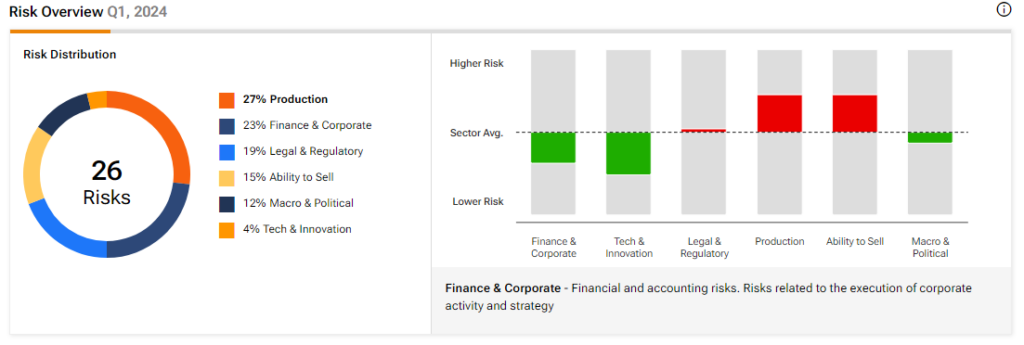

According to the TipRanks Risk Analysis tool, legal and regulatory risk is the third biggest risk factor for the company. Boeing has highlighted this potential risk in its annual filing, stating that it is “subject to U.S. government inquiries and investigations.”

Is Boeing Stock a Buy, Sell, or Hold?

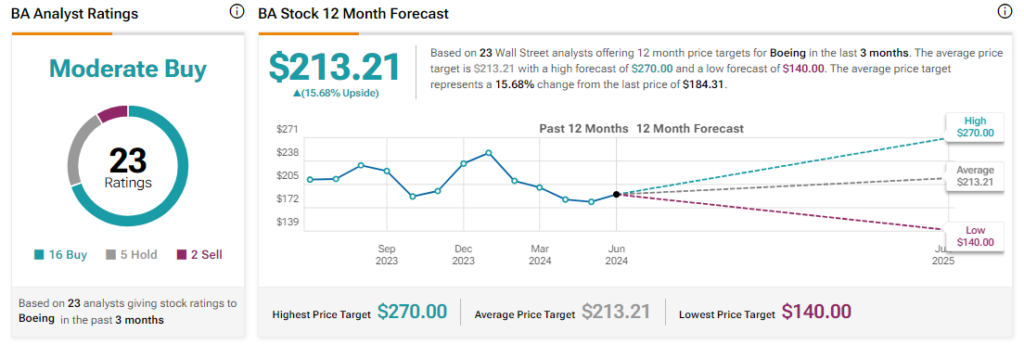

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 16 Buys, five Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a more than 20% loss in its share price year-to-date, the average BA price target of $213.21 per share implies a 15.7% upside potential.