In another setback for Boeing (NYSE:BA), the U.S. Federal Aviation Administration (FAA) has stated that it is issuing a new airworthiness directive for 13 U.S. Boeing 757-200 planes. This directive is due to cracking in the structure in and around the lavatory service panel.

An airworthiness directive is a legally enforceable regulation issued by the FAA to correct an unsafe condition in a product.

The FAA stated that stress concentrations in this area are causing fatigue cracking and could result in in-flight depressurization and reduced structural integrity of the aircraft. This directive affects planes modified by specific supplemental-type certificates. Supplemental-type certificates are issued to aircraft that have modified the existing design.

Boeing’s Run-In with Regulators

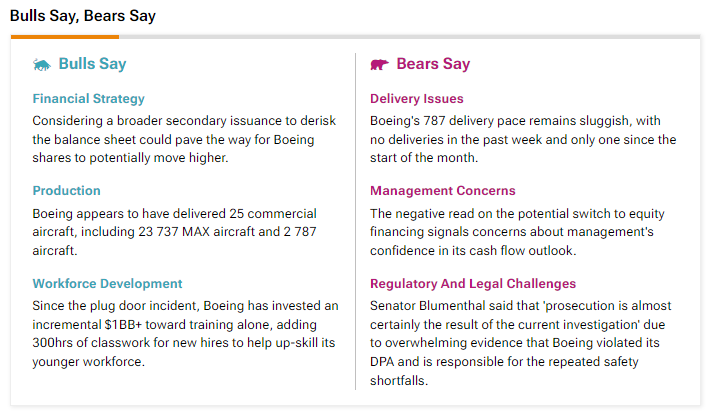

Boeing is facing rising regulatory and legal challenges after a series of accidents involving its aircraft. There is also the possibility that the aerospace major could be facing criminal charges. According to a Reuters report from earlier this week, U.S. prosecutors have recommended to Justice Department officials that criminal charges should be brought against the company. The Justice Department has until July 7 to decide whether to prosecute Boeing.

Indeed, according to the TipRanks Stock Analysis tool, “Bulls Say,Bears Say,” analysts bearish on BA stock highlighted these challenges amid “overwhelming evidence that Boeing violated its [deferred prosecution agreement] DPA and is responsible for the repeated safety shortfalls.”

Is BA Stock a Good Buy?

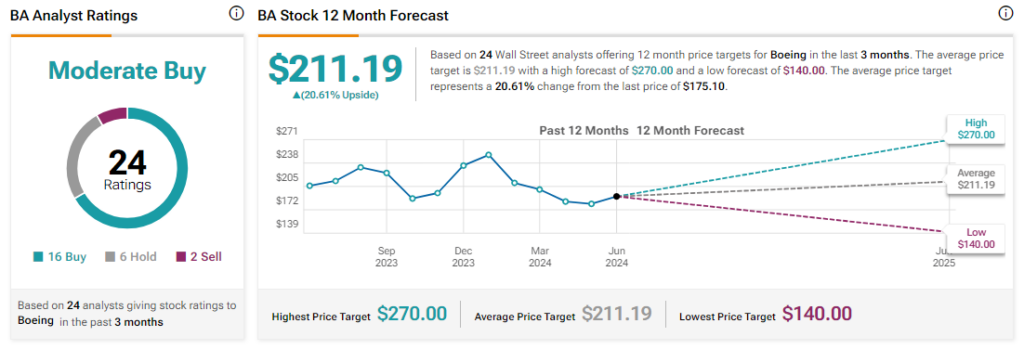

Analysts remain cautiously optimistic about BA stock, with a Moderate Buy consensus rating based on 16 Buys, six Holds, and two Sells. Year-to-date, BA has declined by more than 30%, and the average BA price target of $211.19 implies an upside potential of 20.6% from current levels