Aerospace major Boeing Co. (NYSE: BA) announced its fourth-quarter results with losses narrowing to $0.47 per share from a loss of $1.75 per share in the same period last year. Analysts were expecting Boeing to report a loss of $0.78 per share.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company posted revenues of $22 billion in Q4, up by 10% year-over-year, beating Street estimates of $21.1 billion. At the end of FY23, the company had a total order backlog of $520 billion, including more than 5,600 commercial airplanes.

Boeing CEO David Calhoun stated that it was extremely important for the company to rebuild trust with the regulators and customers after the 737 Max accident and was planning a cautious approach. As a result, the aerospace giant did not issue any guidance for FY24 as it focuses on delivering quality airplanes.

The company has also withdrawn a safety exemption request for its 737 MAX 7 amid the focus on quality.

Is BA a Good Buy Right Now?

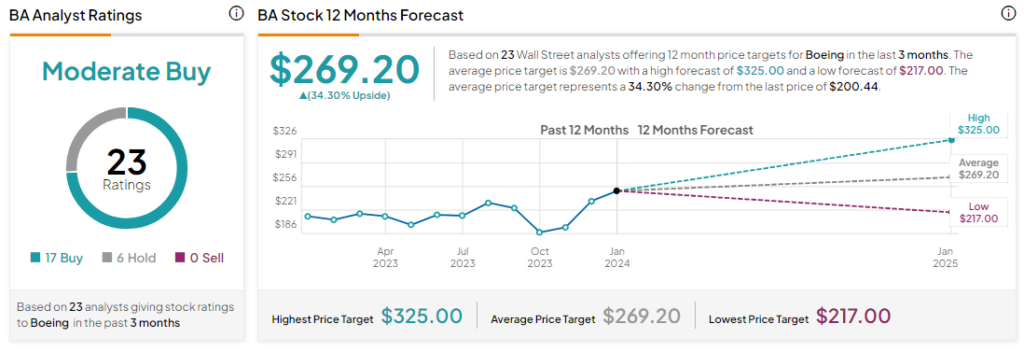

Analysts remain cautiously optimistic about BA stock with a Moderate Buy consensus rating based on 17 Buys and six Holds. The scrutiny of Boeing’s airplanes and the 737 accident has led to BA stock declining by more than 15% over the past month. As a result, the average BA price target of $269.20 implies an upside potential of 34.3% at current levels.