Shares of BioNTech (BNTX) gained in pre-market trading after the company reported better-than-expected Q3 earnings. The biotech company’s earnings increased by 22.7% to €0.81 ($0.89) per share, while analysts were expecting a loss of $1.60 per share.

Furthermore, the company posted revenues of €1.24 billion, an increase of 39% year-over-year. The growth in revenues was largely driven by the earlier approvals for its variants of the COVID-19 vaccines.

Additionally, BNTX is spending heavily on research and development with expenses of €550.3 million, a growth of 10.5% year-over-year as the company is focused on strengthening its oncology and mRNA (messenger ribonucleic acid) drugs pipeline.

BNTX Lowers Revenue Guidance

Looking ahead, the company expects its FY24 revenues to be at the lower end of the range of €2.5 billion to €3.1 billion. BNTX cited “COVID-19 vaccine uptake and price levels, including seasonal variations; inventory write-downs, and other charges by BioNTech’s collaboration partner Pfizer (PFE)” for the lowered outlook. The company has collaborated with PFE for the COVID-19 vaccine.

Is BNTX Stock a Good Buy?

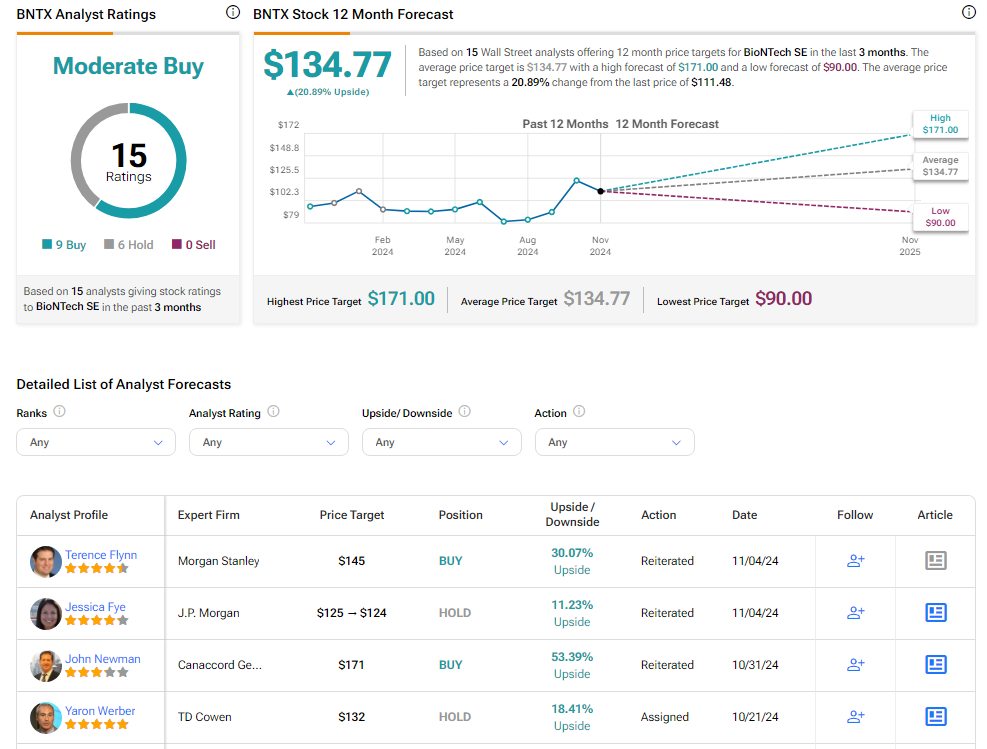

Analysts remain cautiously optimistic about BNTX stock, with a Moderate Buy consensus rating based on nine Buys and six Holds. Over the past year, BNTX has increased by more than 10%, and the average BNTX price target of $134.77 implies an upside potential of 20.9% from current levels. These analyst ratings are likely to change following BNTX’s results today.