According to a Bank of Montreal (TSE: BMO) annual savings study, Canadians are putting savings first as they continue to face the challenges of the global pandemic, and higher inflation is expected over the next year.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Many Canadians do not benefit from the higher returns on longer-term investments.

Cash Is King

BMO’s survey found that of the 63% of Canadians with a Tax-Free Savings Account (TFSA), 67% contributed as much or more than in the past. BMO Economics estimated excess savings to reach nearly C$300 billion at the end of last year, while disposable income rose about 4.5% in 2021.

The study found that cash is the most popular asset — the majority (56%) of Canadians have cash in their TFSAs, and 29% believe it is at least three-quarters of their holdings. Nearly three-quarters of Canadians feel they are familiar with the TFSA, while only half know that a TFSA account can hold both cash and at least one of the other type of investments.

Despite the continuing challenges of the pandemic, Canadians hold an average of C$34,917 in their TFSAs, a 13% increase from 2020.

Canadians primarily use their TFSAs for a variety of financial purposes: 44% use it for retirement savings, 43% use it as a savings account, and only 15% use the account as a way to achieve financial independence as early as possible.

Lack of funds (41%) and other expenses (32%) are the main factors preventing Canadians from contributing to their TFSAs this year. Only 7% of Canadians say they haven’t contributed for reasons related to the pandemic, down 10% from 2020.

Management Commentary

“Throughout the uncertainty of the pandemic, Canadians have remained resilient and optimistic – continuing to prioritize savings and contributing to their TFSAs,” said Nicole Ow, Head, Retail Investments, BMO Bank of Montreal.

“2022 is likely to bring new challenges with growing inflation and economic uncertainty as the pandemic continues into another year. We encourage Canadians to work with an advisor to maximize the benefits of TFSAs and other investment vehicles, such as RRSPs, to help make real financial progress and enable them to meet long- and short-term financial goals.”

Wall Street’s Take

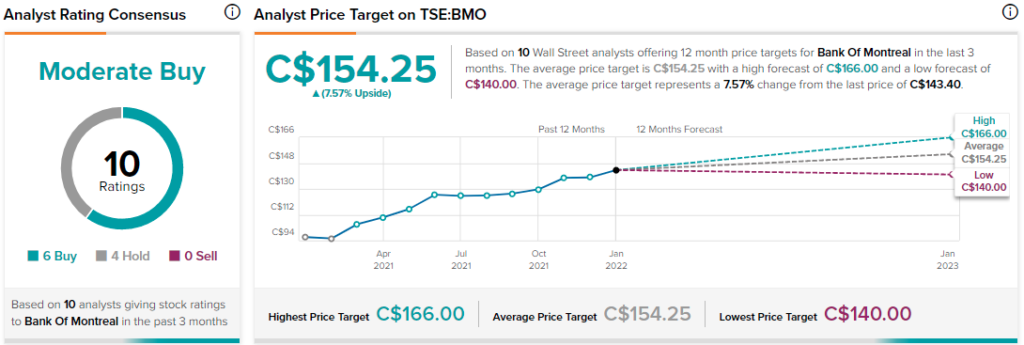

On January 6, RBC Capital analyst Darko Mihelic kept a Buy rating on BMO, with a price target of C$160. This implies 11.6% upside potential.

The rest of the Street is cautiously optimistic on BMO with a Moderate Buy analyst consensus rating based on six Buys and four Holds. The average Bank of Montreal price target of C$154.25 implies 7.8% upside potential to current levels.

Download the TipRanks mobile app now