Shares of Bumble (BMBL) tumbled over 30% in Wednesday’s after-hours trading on weak Q3 forecast and lower guidance for the full-year revenue. The dating platform reported mixed results for the second quarter of Fiscal 2024. Revenues of $268.61 million rose 3.4% year-over-year but came in lower than the consensus of $273.04 million. On the other hand, diluted earnings per share (EPS) jumped 340% year-over-year to $0.22 and easily surpassed the Street’s estimates of $0.15.

Interestingly, Bumble’s paying users grew to 4.1 million from 3.6 million in the year-ago period. However, the average revenue per paying user (ARPPU) fell to $21.37 from $23.23 in Q2 FY23.

Bumble operates online dating platforms under various names, including Bumble, Bumble For Friends, Badoo, Fruitz, and Official. Macro headwinds such as consistently high interest rates and inflation have impacted consumers’ inclination to pay for dating apps. Also, Bumble faces stiff competition from rival Match Group (MTCH), which reported better-than-expected revenue last week.

Bumble’s Disappointing Guidance

For Q3, Bumble guided for revenue in the range of $269 million to $275 million, lower than the consensus of $296.4 million. The main top-line contributor, Bumble App, is expected to generate revenue between $217 million and $221 million.

Furthermore, Bumble slashed its FY24 revenue guidance significantly. For the full year, Bumble now projects revenue to grow by 1% to 2%, down from the earlier growth outlook of 8% to 11%. For reference, the Street had expected full-year revenue growth of roughly 8.4%.

Bumble’s CFO Anu Subramanian said the company reset its guidance to reflect actions it is taking to revive user growth, enhance customer value, and drive long-term revenue growth.

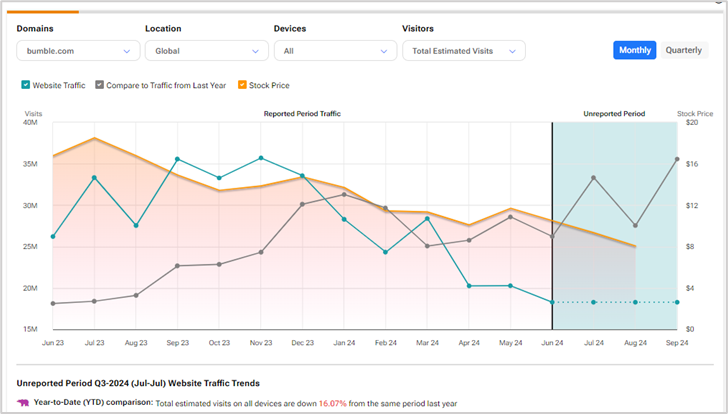

Website Traffic Hinted at Slowing Growth

According to TipRanks’ Website Traffic tool, the total estimated visits to all of Bumble’s apps and websites worldwide fell by 16.07% in the year-to-date period compared to last year. The weak website footprint hinted at slowing growth for the second quarter, ahead of the results.

Is BMBL Stock a Good Buy?

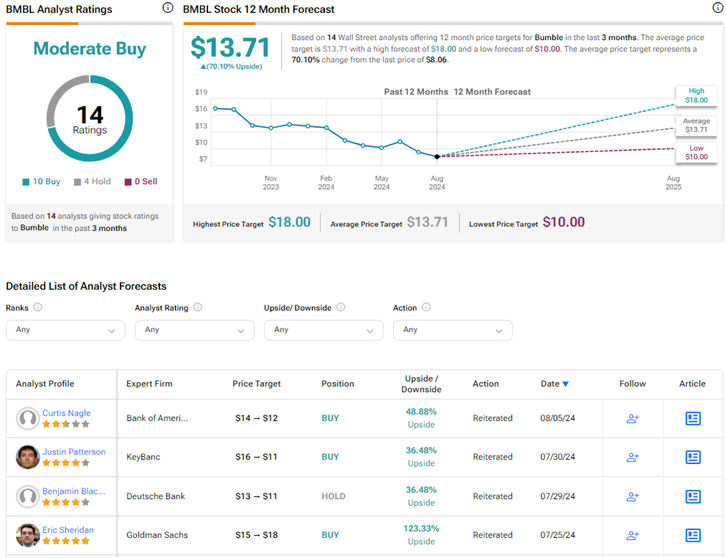

On TipRanks, BMBL stock currently has a Moderate Buy consensus rating based on ten Buys versus four Hold ratings. The average Bumble price target of $13.71 implies 70.1% upside potential from current levels, while shares have lost 45.3% year-to-date.

It is important to note that these analysts’ ratings and price targets were given prior to the results and might be revised based on the Q2 performance and dismal outlook.