BlueLinx Holdings Inc. (BXC) shares jumped 6.6% in Monday’s extended trading session after the company made dual announcements: the termination of its “at-the-market” equity offering program, as well as the authorization of a new share repurchase program of up to $25 million.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Shares of the American wholesaler and distributor of building and industrial products have gained 157% over the past year. (See BlueLinx Holdings stock charts on TipRanks)

The company believes that it has sufficient liquidity and chose to terminate the equity offering, thereby alleviating shareholders’ concerns regarding the dilution of shareholders’ interests.

BlueLinx began the 10-trading day termination process of the equity offering with Jefferies, with the official termination effective on September 2, 2021. The company did not sell any shares under the offering.

Regarding share repurchases, the company said that the timing of the $25 million buybacks will be subject to many factors, like the company’s need for additional capital, the market price of the shares, market conditions, and other corporate considerations.

BlueLinx CEO Dwight Gibson commented, “Given the strong performance of our business during the past year, coupled with a favorable multi-year outlook for residential construction and home renovation markets, we believe our capital allocation strategy should prioritize a combination of organic growth investments, the acquisition of complementary assets in key target markets and an opportunistic return of capital program.”

Loop Capital Markets analyst Jeffrey Stevenson recently increased the price target on BlueLinx from $45 to $52 (5.8% downside potential) and reiterated a Hold rating on the stock.

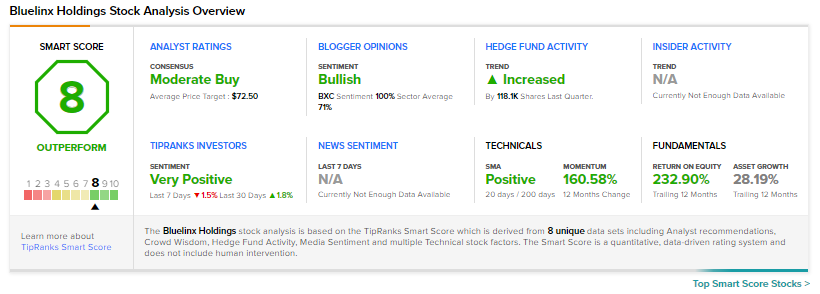

Consensus among analysts is a Moderate Buy based on 1 Buy and 1 Hold. The average BlueLinx Holdings price target of $72.50 implies 31.3% upside potential to current levels.

BXC scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Boqii Holding Delivers Q1 Beat; Shares Rise 3.6%

Nokia Expands 5G Footprint with A1 Telekom into New Markets

Timken Snaps up Intelligent Machine Solutions