After several months of searching, restaurant holding company Bloomin’ Brands (BLMN) has settled on a new CEO from an unexpected field. Delta Airlines (DAL) chief operating officer (COO) Michael Spanos will be taking over the top slot at Bloomin’. Investors, however, might be frightened by airline influence on the menu and sent Bloomin’ shares down over 3% in Monday afternoon’s trading.

While Bloomin’s current CEO, David Deno, will remain in place for the rest of the year, serving in a “transitional role,” Spanos will step in starting in September. Some question whether Spanos can translate airline experience into restaurant knowledge, but given that Spanos served at Pepsi (PEP) and Six Flags (FUN), he might have enough of a background to be effective at Bloomin’ Brands.

The Bloomin’ Brands label has faced quite a bit of trouble in recent months as it struggles to keep diners coming back in. Meanwhile, a recent earnings miss and downward guidance revision suggest that the problems may be more pronounced than expected. As a result, investors may not be too enthused about an airline executive.

Consumer Pressures and Simplified Menus

Bloomin’ Brands has already made several moves in a bid to improve its outlook. Earlier this month, it announced plans to simplify its menu at several locations, which should make ordering easier and more cost-effective.

This news comes at an excellent time. As far back as May, Bloomin’ noted that consumers were increasingly “pressured” by economic conditions. That means Bloomin’ is already well aware that its sales will slump, so it is working to head off that change by economizing. That should help it weather the downturn accordingly.

Is Bloomin’ Brands a Good Stock to Buy?

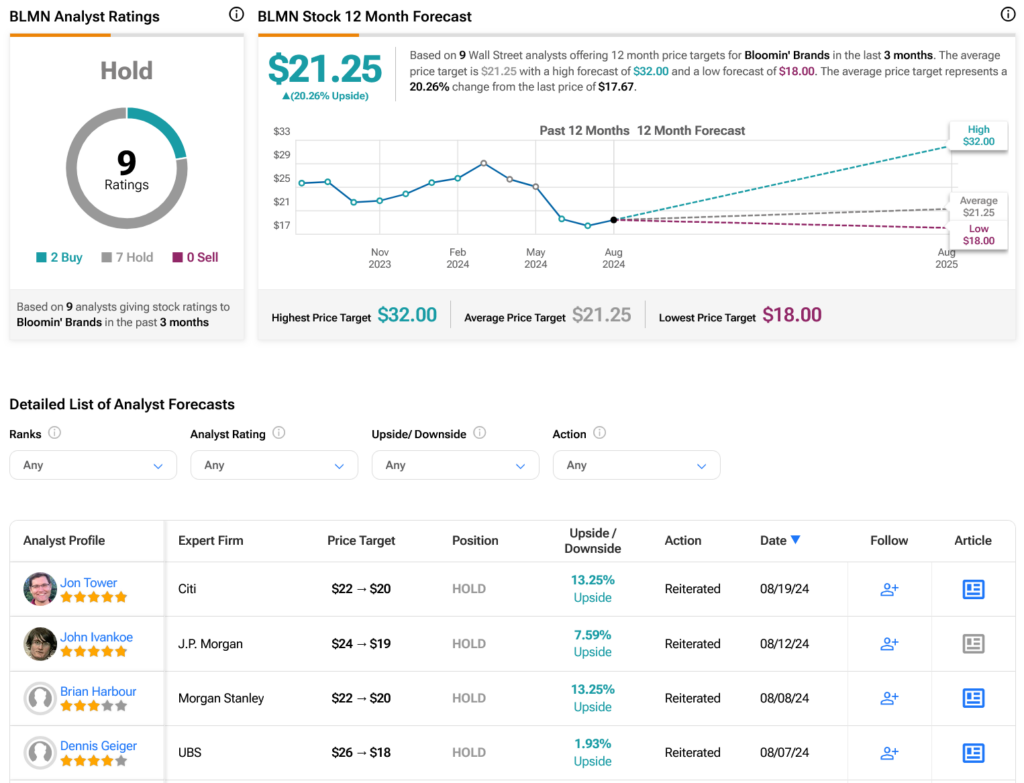

Turning to Wall Street, analysts have a Hold consensus rating on BLMN stock based on two Buys and seven Holds assigned in the past three months, as indicated by the graphic below. After a 31.79% loss in its share price over the past year, the average BLMN price target of $21.25 per share implies 20.26% upside potential.