The Blackstone Group has agreed to sell a 33% stake in clean energy company Industrie De Nora to Italy’s Snam S.p.A., one of the world’s leading energy infrastructure operators.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The deal values De Nora at about €1.2 billion ($1.4 billion). The stake acquisition from funds managed by Blackstone (BX)Tactical Opportunities is expected to be completed in the first quarter of 2021, pending antitrust clearances.

Headquartered in Milan, and established in 1923 as a family business, De Nora has been a pioneer in electrochemistry and has focused on helping organisations find sustainable solutions for a variety of industrial processes, from basic chemicals production and electronics to energy storage and water treatment systems and solutions.

“Our investment in De Nora builds on Blackstone’s successful history of supporting entrepreneurial family businesses to achieve their goals,” said Andrea Valeri, Senior Managing Director and Chairman of Blackstone Italy. “We are proud to have helped take a leader in sustainable solutions into new arenas including the coming Energy Transition and Hydrogen Economy, whilst achieving worldwide recognition as the innovation partner of choice for next-generation environmental technologies.”

Blackstone first invested in De Nora in August 2017. Since then, the company has performed strongly, achieving organic growth whilst driving innovation in new, sustainable products and patented technologies, and breaking into attractive new end-markets such as hydrogen energy, the private equity firm said.

De Nora generates revenues of more than €500 million per year (60% in electrodes, 40% in water treatment), with an expected EBITDA of € 90 million in 2020 and an average growth (CAGR) of 8% over the past three years.

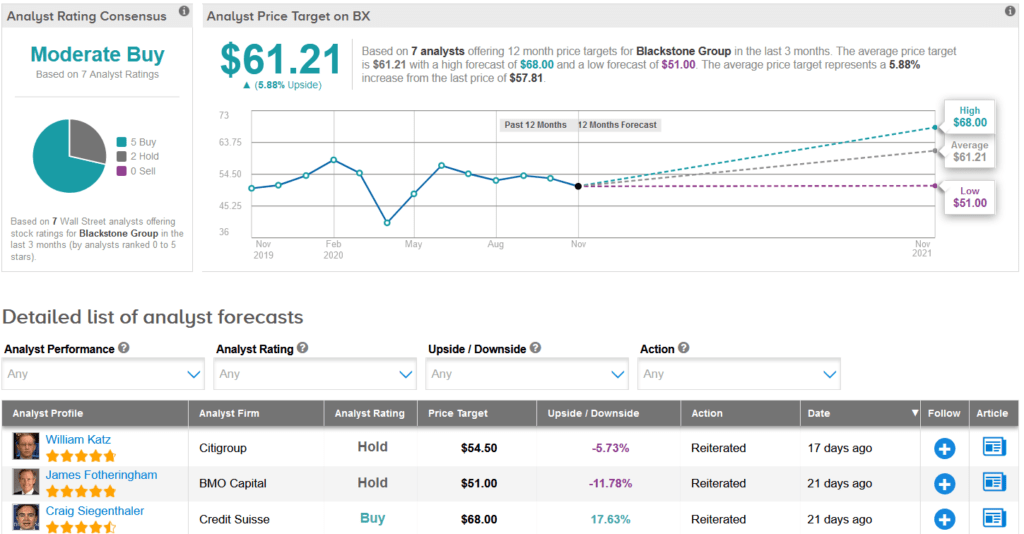

Turning now to BX, the stock has in recent weeks recouped all of this year’s earlier losses and is now up 3.3% since the beginning of 2020. Looking ahead, the average analyst price target of $61.21 indicates another 6% upside potential is lying ahead over the coming year.

Oppenheimer analyst Chris Kotowski at the end of last month upgraded the stock to Buy from Hold with a $58 price target, following the company’s better-than-expected third quarter results.

“Fund performance was exceptional, helping to build the carried interest receivable, which bodes well for future earnings,” Kotowski commented in a note to investors.

The strong Q3 combined with the stock’s pullback last month makes it “much more compelling near term” and provides a good entry point, the analyst summed up.

Overall, BX scores a Moderate Buy analyst consensus which breaks down into 5 Buys versus 2 Holds. (See Blackstone stock analysis on TipRanks).

Related News:

Online Education Provider K12 Changes Name to Stride; Announces Two Acquisitions

IBM To Acquire SAP Firm TruQua To Bolster Hybrid Cloud Growth

Installed Building Snaps Up WeatherSeal Insulation; Street Is Bullish