Insider reports claim that Mitsubishi Chemical Group is taking bids for Mitsubishi Tanabe Pharma in a deal that could value the unit between $3 billion and $3.5 billion. According to these reports, Mitsubishi Chemical has retained Goldman Sachs (GS) to manage the sale of the pharmaceutical unit.

The reports note that three private equity firms—Blackstone (BX), Bain Capital, and Japan Industrial Partners—are making final bids for Mitsubishi Tanabe Pharma. They have until Dec. 24 to submit their binding offers for the Mitsubishi Chemical unit.

What Mitsubishi Tanabe Pharma Has to Offer

Mitsubishi Chemical Group has reported strong numbers for Tanabe Pharma during its current fiscal year. That includes revenue of 232.5 billion yen during the first half, which is a 6% increase year-over-year. Additionally, core operating income of 41.4 billion yen was up 28% during that period.

Mitsubishi Tanabe Pharma also has several drugs in development. Its current projects include medicines that target the central nervous system, immuno-inflammation, and oncology.

Blackstone vs. Bain Capital vs. Japan Industrial Partners: Who Will Win?

Just comparing size, Blackstone has an obvious advantage over Bain Capital and Japan Industrial Partners in this bidding war. It’s the largest private equity firm in the world, with more than $941 billion in assets under management. Bain Capital and Japan Industrial Partners don’t even make it into the top 10 under that metric. However, Japan Industrial Partners does have the home-field advantage as it and Mitsubishi Chemical are both based in Japan.

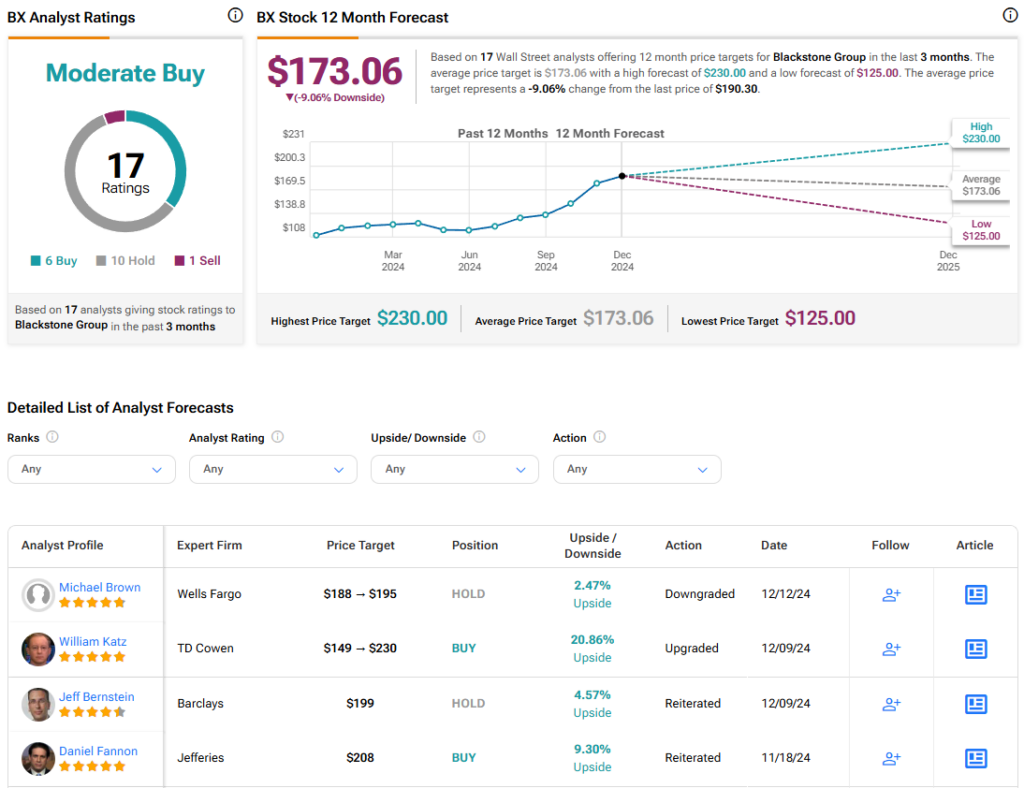

Blackstone is also the only one of the three that is publicly traded. Analysts have a consensus Moderate Buy rating based on six Buy, 10 Hold, and one Sell ratings over the last three months. With that comes an average price target of $173.06, a high of $230, and a low of $125. This represents a potential 9.06% downside for BX shares.

Questions or Comments about the article? Write to editor@tipranks.com