BlackRock (BLK) delivered better-than-expected Q3 2021 results for the period ended September 30, 2021. Revenue and earnings came in above consensus estimates as the company benefited from clients increasingly seeking advice and insight regarding their portfolios. BLK shares rose 3.78% to close at $867.81 on October 13.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

BlackRock is an investment manager that offers its services and financial technology to institutional intermediaries and individual investors. It also offers global risk management and advisory services.

Q3 revenue was up 16% year-over-year to $5.05 billion, exceeding consensus estimates of $4.88 billion. The increase underscores strong organic growth and growth in technology services revenue, which helped offset lower performance fees. (See Top Smart Score Stocks on TipRanks)

Diluted EPS, on the other hand, increased 19% compared to the same quarter last year to $10.95, beating consensus estimates of $9.78. The increase reflects higher non-operating income. BlackRock also benefited from strategic minority investments that led to non-cash gains.

Long-term net inflows of $98 billion represent 9% annualized organic base fee growth, marking the sixth consecutive quarter of growth in excess of the 5% target. Additionally, BlackRock delivered the tenth consecutive quarter of active equity inflows and client demand with $31 billion streaming from sustainable active and index strategies.

According to CEO Laurence D. Fink, the focus going forward remains on staying ahead of clients’ needs and helping more people achieve financial wellbeing.

Fink stated, “Whether through expanding investment choices, developing new retirement solutions, or enhancing our data analytics and technology capabilities, BlackRock remains committed to investing in high growth opportunities and industry-leading innovation.”

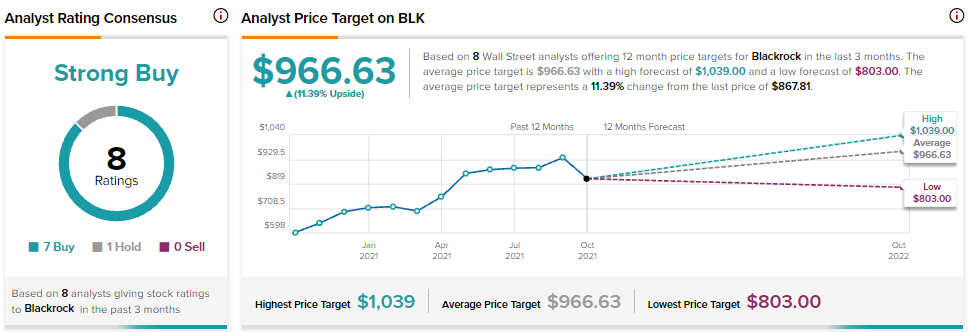

Yesterday, Jefferies analyst Daniel Fannon reiterated a Buy rating on the stock with a $978 price target, implying 12.70% upside potential to current levels.

Consensus among analysts is a Strong Buy based on 7 Buys and 1 Hold. The average BlackRock price target of $966.63 implies 11.39% upside potential to current levels.

Related News:

Scotiabank Commits Additional $250K to Afghan Interpreters, Civilians

TD, Canadian Association of Black Lawyers Launch Programs

JPMorgan Q3 Results Beat Expectations