BlackBerry Limited (BB), once a dominant player in the smartphones segment, has transformed into a specialist provider of enterprise software and the Internet of things (IoT) services. This year, the company has caught the “meme stock” frenzy, with traders swinging the stock to its 52-week high of $28.77 on January 27.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The stock has been increasingly volatile due to the frenzy and has lost 15% in the last week alone. BB shares are up over 100% since the beginning of the year.

With BlackBerry coming to light lately, much is anticipated about the company’s business model and its ability to rise above the “meme-stock” game. (See BlackBerry stock analysis on TipRanks)

Recently, the company announced that its QNX® Neutrino® Realtime Operating System (RTOS) has been adopted in a new digital LCD cluster, jointly built with BiTECH Automotive (Wuhu) Co. Ltd, and is to be installed in Changan Automobile’s newly launched UNI-K SUV.

In May, the company launched the BlackBerry Optics 3.0, its next-generation cloud-based endpoint detection and response (EDR) solution, and BlackBerry Gateway, which provides a comprehensive defense against threats targeting devices, networks, and user identity.

Notably, BB has been surpassing the Street’s estimates over the past year. The company is scheduled to report its Q1 FY22 earnings on June 24. The Street’s estimates for revenue and earnings are pegged at $171.25 million and $(0.05) per share.

On April 29, after attending BlackBerry’s Analyst Day, Canaccord Genuity analyst Michael Walkley maintained a Hold rating on the stock and lifted the price target to $10 (from $9), which implies 28.8% downside potential to current levels.

Walkley said, “We participated in BlackBerry’s Analyst Day and come away with increased conviction in the company’s focus on growing its software and services segment as the company is targeting a total $89B Total Addressable Market by 2025. The recent management promotions to head the security and IoT verticals help solidify the company’s commitment to aligning operations with sales, which we see as critical to driving future growth.”

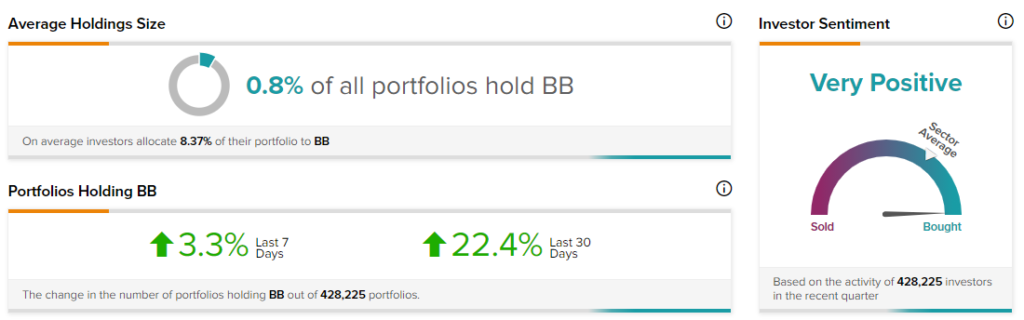

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on BlackBerry, with 19.3% of investors increasing their exposure to BB stock over the past 30 days.

Related News:

General Electric and Safran to Develop New Jet Engine, Extend CFM Partnership to 2050

Magnachip Receives Hostile Bid from Cornucopia; Shares Jump 12%

Nvidia Buys DeepMap, Enhance Autonomous Vehicle Mapping Precision