BlackBerry (BB) has announced that the IPU-03, a self-driving domain controller developed with Desay SV Automotive, has been officially mass produced in the Xpeng P7.

This is a super-long range, high-performance and fast-charging intelligent EV sports sedan from Xpeng Motors, one of China’s leading electric vehicle and technology companies.

As the operating system for the IPU-03, BB’s QNX OS for Safety powers the Xpeng P7’s intelligent driving system.

QNX OS for Safety is a software solution that provides the reliable foundation necessary for building competitive automotive and mission-critical systems in a cost-effective and safe manner, says BlackBerry.

Available in China, the Xpeng P7 is one of the world’s leading autonomous EVs and carries the Desay SV automatic driving domain control unit – the IPU-03. T

Through multi-sensor data collection, the IPU-03 calculates the vehicle’s driving status and provides 360-degreee omnidirectional perception with real time monitoring of the surrounding environment to make safe driving decisions.

“We are excited to work with BlackBerry QNX who is known for its safety, security, and real-time capabilities,” commented Li Huang, of Desay SV Automotive. “Our relationship with BlackBerry QNX allows both companies to improve our product advantages in the field of autonomous driving with a view to providing car manufacturers and users with safe, high-performance and smart mobility solutions.”

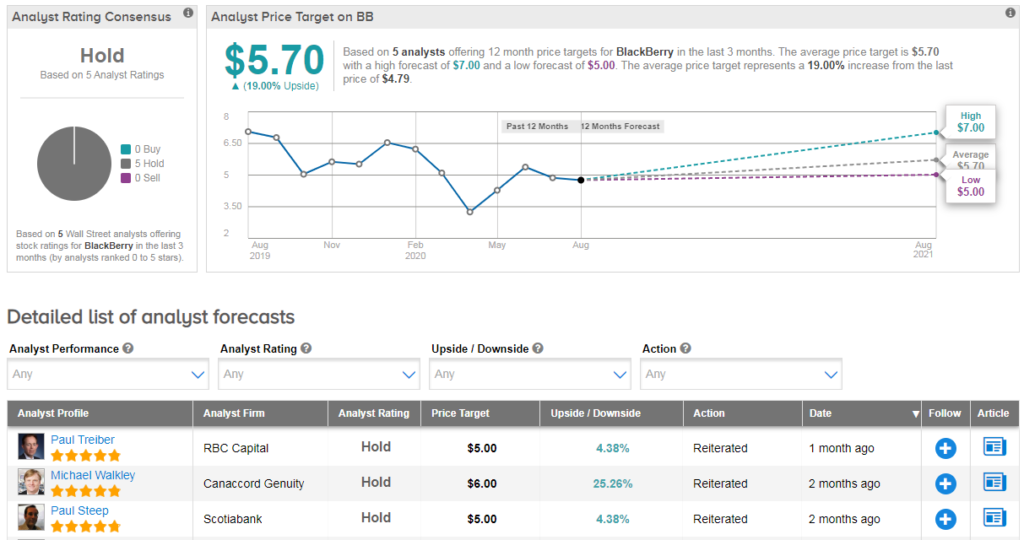

Shares in BlackBerry have plunged 25% year-to-date, and the Street has a cautious Hold consensus on the stock’s outlook with 5 recent hold ratings. The average analyst price target of $5.70 indicates 19% upside potential from current levels.

“Maintain Sector Perform, as valuation may remain near trough levels, pending growth re-acceleration” commented RBC Capital analyst Paul Treiber recently. His hold rating comes with a $5 price target.

According to the analyst, BlackBerry has successfully transitioned its business away from handsets to enterprise software but stronger growth is required to drive material upside for the shares.

“BlackBerry has secured a number of design wins in the automotive segment. While positive, we believe the future revenue from these design wins is difficult to predict considering that penetration is unknown and pricing pressure has reduced ASPs in the automotive segment” the analyst told investors. (See BB stock analysis on TipRanks).

Related News:

Palo Alto Beats 4Q Estimates Spurred By Remote Working Trend

Amazon Launches Spotify Rival With Cheaper All-You-Can-Listen Audio Service

Microsoft Warns Of Significant Fallout From Apple’s Battle With Epic Games