BlackBerry (BB) shares jumped over 9% in pre-market trading on Thursday after the company delivered stronger-than-expected fiscal second-quarter results topping both earnings and revenue estimates.

Markedly, shares of the provider of intelligent security software and services to firms and governments globally have gained almost 100% over the past year. (See BlackBerry stock charts on TipRanks)

The company reported an adjusted loss of $0.06 per share, better than analysts’ expectations of a loss of $0.07 per share. Comparatively, the company reported adjusted earnings of $0.10 per share in the prior-year period.

However, revenues declined 32% year-over-year to $175 million but exceeded consensus estimates of $163.5 million.

Segment-wise, IoT business unit revenues grew 29% year-over-year to $40 million despite constraints from global chip shortages. Cyber Security revenue remained flat at $120 million and was driven by strong sequential billings and revenue growth. Licensing & other revenue came in at $15 million during the quarter.

BlackBerry CEO John Chen commented, “In IoT, design activity for our QNX products remains very strong, demonstrating both our industry leadership position and secular trends, such as ECU consolidation. In Cyber Security we received strong third-party validation of the effectiveness of our AI-driven, prevention-first suite of products, illustrating progress made with recent product launches.”

The company also revealed that BlackBerry’s President and COO, Tom Eacobacci, will leave the company on October 29th to pursue other opportunities. Additionally, John Giamatteo has been appointed President of Cyber Security.

RBC Capital analyst Paul Treiber recently maintained a Sell rating on the stock with a price target of $7.43 (22.3% downside potential).

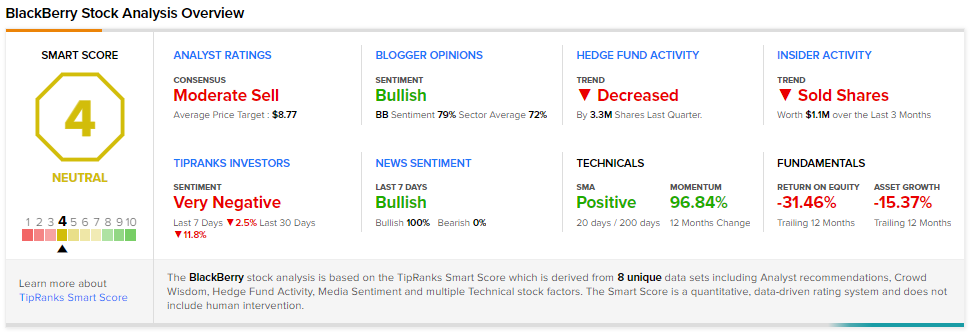

Overall, BB scores a Moderate Sell rating among Wall Street analysts based on 1 Hold and 3 Sells. The average BlackBerry price target of $8.77 implies 8.3% downside potential to current levels.

BB scores a 4 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock is likely to perform in line with market expectations.

Related News:

Stitch Fix Delivers Surprise Q4 EPS Beat; Shares Leap 17%

InnovAge Posts Mixed Q4 Results; Shares Drop 6.4% Pre-Market

Carrier Global Corporation To Snap Up Nlyte Software