Shares of oil and natural gas company Black Stone Minerals (BSM) fell 2.4% in Monday’s extended trading session after the company reported weaker-than-expected second-quarter results.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Adjusted earnings of $0.05 per share lagged analysts’ expectations of $0.12 per share. The company reported a loss of $0.07 per share in the prior-year period.

Revenues increased to $58.4 million compared to $38.5 million in the prior-year quarter but fell short of consensus estimates of $79.8 million. The increase in revenues reflected a surge in oil and condensate sales, which more than doubled to $53.9 million.

Notably, the average realized price per barrel of oil equivalent (Boe) jumped 121% year-over-year to $31.79 compared to $14.37 a year ago. (See BSM stock charts on TipRanks)

Black Stone Minerals CEO Thomas L. Carter, Jr. said, “In addition to better fundamentals, our results for the quarter were bolstered by strong lease bonus payments and higher gas price realizations stemming from the February Texas storms.”

He further added, “Most importantly, the positive results combined with our low debt levels allowed us to prioritize returning cash flow to our unitholders in the form of increased distributions. We look forward to building on this positive momentum into 2022.”

During the quarter, the company announced a distribution of $0.25 per unit, which included a special distribution of $0.05 per unit due to the benefit from a positive one-time item.

Based on better-than-expected production in the first half of 2021, the company updated its full-year 2021 guidance. Total production is forecast to be in the range of $34.5 – $37 million Boe per day, versus the prior guidance range of $33.5 – $36.5 million Boe per day.

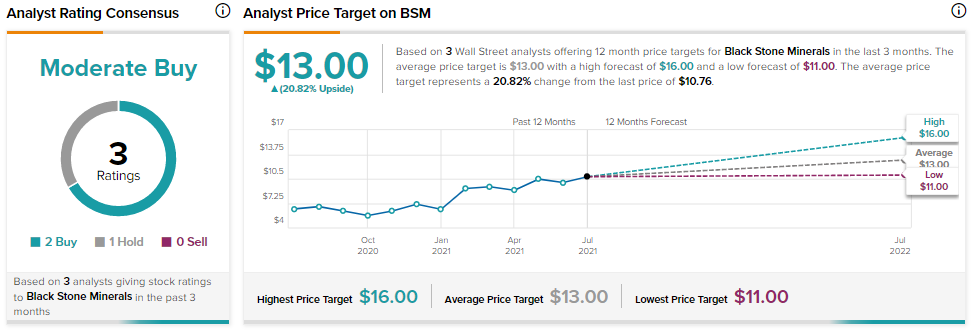

Raymond James analyst John Freeman recently reiterated a Buy rating on the stock with the price target of $16 (48.7% upside potential).

Freeman forecasts the company to report earnings of $0.05 per share for the third quarter of 2021.

Overall, the stock has a Moderate Buy consensus rating based on 2 Buys and 1 Hold. The average Black Stone Minerals price target of $13 implies 20.8% upside potential from current levels. Shares of BSM have jumped 47% over the past year.

Related News:

Caterpillar Delivers Robust Q2 Results; Shares Fall 2.7%

Illinois Tool Works Posts Upbeat Q2 Results, Raises Guidance

Grainger Misses Q2 Earnings Expectations, Mutes Guidance