Shares of online travel and related services provider Booking Holdings (NASDAQ:BKNG) fell about 9.33% in Thursday’s after-hours trading despite the company reporting better-than-expected Q4 results. This notable decline in BKNG stock could be in response to the company’s disclosure of a regulatory matter.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Booking Holdings said that the Spanish Competition Authority has issued a preliminary decision accusing Booking.com of violating Spanish competition laws. The company added that the regulator has proposed a substantial fine of $530 million. Nonetheless, BKNG has stated its intention to appeal if the preliminary decision leads to a fine.

BKNG stock is up about 61% in one year, as solid leisure travel demand drove its gross bookings and net income. With this backdrop, let’s zoom in on Booking Holdings’ Q4 performance.

BKNG Exceeds Analysts’ Q4 Expectations

Booking Holdings delivered total revenue of $4.78 billion in Q4, up 18% year-over-year. Higher gross travel bookings and increased room nights booked drove its top-line growth. Further, the company’s sales exceeded the analysts’ expectations of $4.71 billion.

The company’s adjusted earnings of $32 per share jumped 29% year-over-year, surpassing the Street’s consensus estimate of $29.68.

The company’s management remains upbeat and sees resiliency in global leisure travel demand, which will likely boost its financials. BKNG returned over $10 billion to shareholders in 2023 through share buybacks. Alongside share repurchases, Booking Holdings surprisingly announced its first dividend payout during the Q4 conference call. It declared a quarterly cash dividend of $8.75 per share, payable on March 28.

Is Booking Holdings a Buy or Sell?

Booking Holdings stock is likely to benefit from ongoing momentum in leisure travel demand. However, tough year-over-year comparisons pose challenges, keeping analysts cautiously optimistic about its prospects.

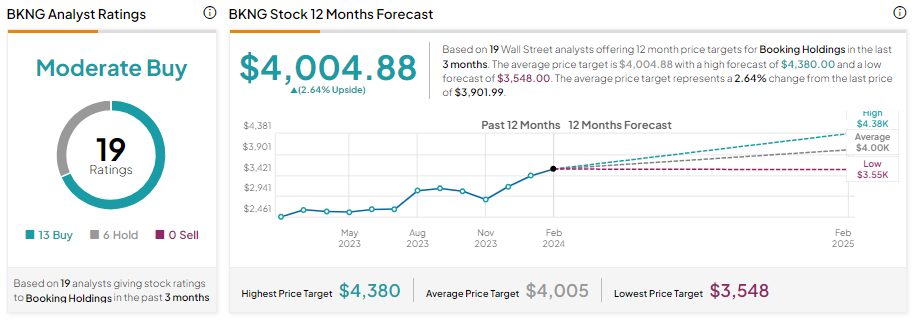

It has 13 Buy and six Hold recommendations for a Moderate Buy consensus rating. Analysts’ average price target of $4,004.88 implies a limited upside potential of 2.64% from current levels.