Shares of Bitfarms (BITF) are down at the time of writing after the Bitcoin (BTC-USD) miner provided a production update. Indeed, October Bitcoin production dropped 41% year-over-year to 236 BTC. The company, along with the broader industry, is likely still feeling the impact of the April Halving (an event that reduced the reward for mining Bitcoin).

Nevertheless, production increased by 8.7% compared to September, when the firm mined 217 BTC. This was despite an 8% increase in Bitcoin mining difficulty. In addition, the firm saw an 80% year-over-year jump in its average hash rate (the number of calculations a miner can perform per second) to 10.6 EH/s. On a month-over-month basis, it increased by 3%.

However, CEO Ben Gagnon noted that the company is behind schedule when it comes to achieving its mid-year hash rate target of 12 EH/s. Gagnon attributed this delay to warranty servicing of the firm’s mining equipment.

Bitfarms Increases BTC Holdings

Bitfarms now holds 1,188 BTC (an increase of 42 BTC month-over-month) worth roughly $84 million at the time of writing, or slightly less than a tenth of its $888 million market cap. Furthermore, it has 802 long-dated BTC call options (up from 602 at the end of September) as part of its Synthetic HODL strategy.

Interestingly, BITF is trading at a price-to-book value of 2.04, according to TipRanks data, which suggests that the company is overvalued since it is above 1.0. Although earnings are generally a better measure of value, since BITF is unprofitable and derives most of its valuation from its Bitcoin holdings, book value seems like a more appropriate measure.

Is Bitfarms Stock a Good Buy?

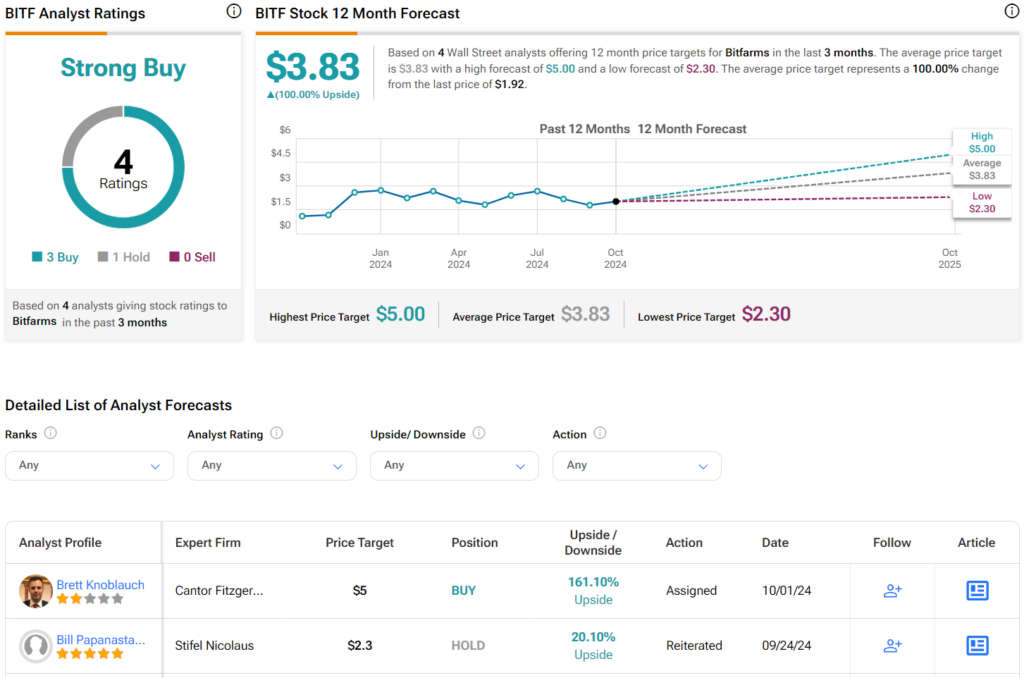

Despite the seemingly expensive valuation, Wall Street analysts have a Strong Buy consensus rating on BITF stock based on three Buys, one Hold, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 62% rally in its share price over the past year, the average BITF price target of $3.83 per share implies 100% upside potential.