Bitcoin exchange-traded products (ETPs) brought in $213 million in inflows last week, making it the star performer in a turbulent crypto market. Despite the broader Bitcoin sell-off, the cryptocurrency remains 2025’s best-performing asset with $799 million in year-to-date inflows, according to CoinShares. Total assets under management (AUM) in Bitcoin ETPs fell 3.5%, dropping to $125.4 billion, as macroeconomic data and hawkish signals from the U.S. Federal Reserve dampened investor sentiment.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Altcoins Gain Traction amid Ethereum Outflows

While Ethereum (ETH-USD) suffered $256 million in outflows due to a broader tech sell-off, XRP gained momentum with $41 million in inflows. This surge is linked to optimism surrounding Ripple’s ongoing legal battle with the SEC, with a key appeal deadline approaching. Smaller altcoins like Aave (AAVE-USD), Stellar (XLM-USD), and Polkadot (DOT-USD) also drew attention, raking in $2.9 million, $2.7 million, and $1.6 million, respectively.

Geographic Trends Highlight Switzerland’s Outflows

The U.S. led crypto ETP inflows with $79 million, followed by Germany and Canada. However, Switzerland saw the highest outflows at $85 million, with Hong Kong and Sweden also experiencing declines.

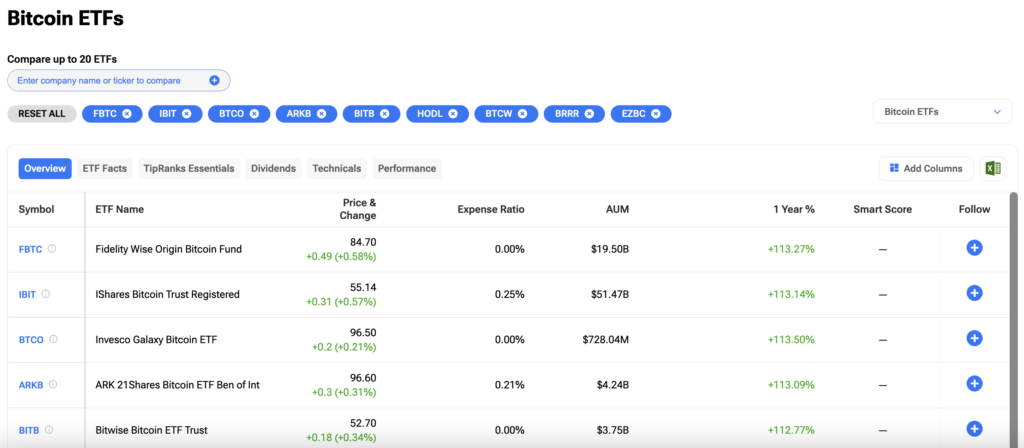

What Is the Best Bitcoin ETF to Buy?

For investors looking to find the Bitcoin ETFs that best suit their needs, conducting thorough research is crucial. A helpful resource for this is TipRanks’ Compare ETF tool. This tool allows investors to compare various Bitcoin ETFs side-by-side, examining key metrics such as performance history, expense ratios, and assets under management.