Bitcoin ETFs See Record Withdrawals as Demand Weakens

Bitcoin’s recent struggles haven’t gone unnoticed in the ETF market. Investors yanked a record $671.9 million from U.S.-listed spot Bitcoin ETFs on Thursday, marking the end of a 15-day streak of inflows, according to Coinglass and Farside Investors.

Spot Bitcoin ETFs Face Significant Outflows

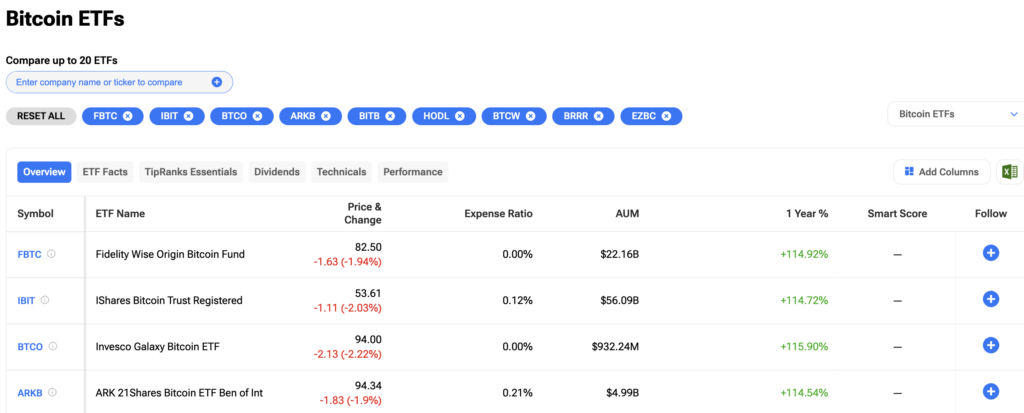

The biggest culprits behind the pullback were Fidelity’s FBTC (FBTC) and Grayscale’s GBTC (GBTC), which shed $208.5 million and $188.6 million, respectively. Even BlackRock’s IBIT (IBIT), which has enjoyed strong inflows in recent weeks, recorded no new activity. These withdrawals come on the heels of Bitcoin extending its post-Fed meeting losses, falling to $96,000—a sharp drop from its earlier $108,268 peak this week.

Futures Premium Reflects Weakening Demand

Adding to the bearish mood, the premium on CME’s one-month Bitcoin futures slipped below 10% for the first time in over a month, Amberdata reports. This decline points to waning enthusiasm among traders, as cash-and-carry arbitrage opportunities have become less lucrative.

Ether ETFs Follow Bitcoin’s Lead

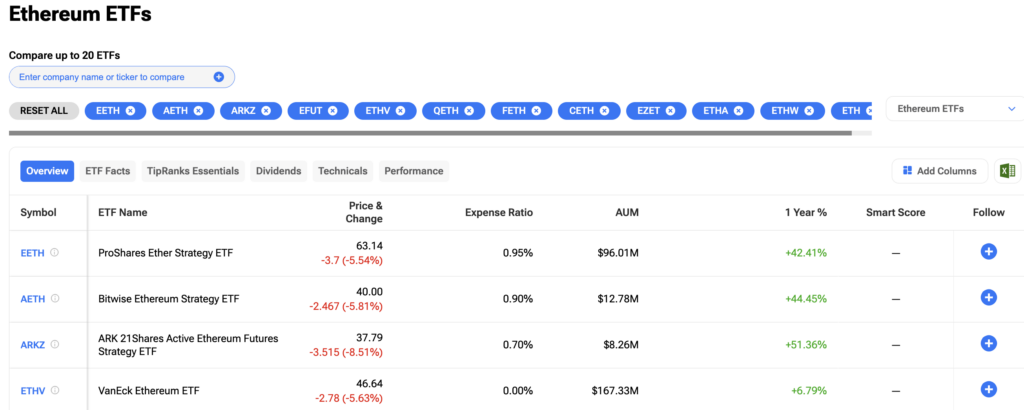

It wasn’t just Bitcoin feeling the pressure. Ethereum ETFs saw their first net outflow since November 21, with $60.5 million withdrawn. Ethereum’s price has tumbled 20% since the Fed’s latest decision, leaving investors wary.

Investors can track Bitcoin ETFs and Ethereum ETFs on Tipranks. Click on the images below for more details.