Institutional investors are increasingly betting on Bitcoin (BTC-USD) ETFs, even with recent market turbulence. According to Bitwise’s latest report, the number of institutional investors holding Bitcoin ETFs rose by 14% in the second quarter, reaching 1,100. This is the fastest adoption rate for any ETF in history, despite Bitcoin’s price falling 12% during the same period.

Confidence Shown Despite Market Dip

Bitwise’s Chief Investment Officer, Matt Hougan, observed that institutional interest remains strong, noting, “If institutions will buy Bitcoin when prices are volatile, imagine what could happen in a bull market.” The share of assets under management in Bitcoin ETFs increased to 21.15% from 18.74%, with institutions holding $11 billion in these funds.

Bitcoin ETFs Attract Big Players

The report challenges the notion that Bitcoin ETFs are mainly for retail investors. With Wall Street giants like Goldman Sachs (GS) holding positions in seven out of eleven Bitcoin ETFs, the influx of institutional capital signals a promising future. Bitwise predicts that ETF inflows will continue to grow, with even larger investments expected in the coming years.

What Is the Best Bitcoin ETF to Buy?

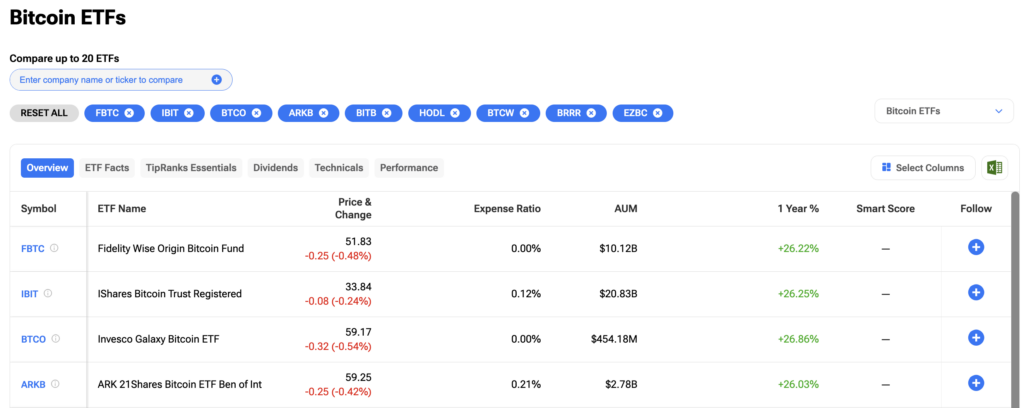

For investors looking to find the Bitcoin ETFs that best suit their needs, conducting thorough research is crucial. A helpful resource for this is TipRanks’ Compare ETF tool. This tool allows investors to compare various Bitcoin ETFs side-by-side, examining key metrics such as performance history, expense ratios, and assets under management.