Bitcoin (BTC-USD) recently fell below $58,000, causing a lot of worry and confusion in the market. The liquidations data tracked by CoinGlass shows that this huge drop drop led to $230 million in forced sales of futures, which are bets on future prices.

For those betting on rising prices, the liquidations were the highest since the end of June. Binance, a cryptocurrency exchange, had more than $110 million in liquidations, the largest amount compared to other exchanges.

What Happened?

- Mt. Gox Repayments: A closed exchange called Mt. Gox will soon pay back stolen Bitcoin to its users. This will add more Bitcoin to the market, which could lower the price even more.

- Miner Sales: Bitcoin miners might also sell their Bitcoin. This adds even more Bitcoin to the market, pushing the price down.

Why This Matters

Bitcoin falling below $59,000 is a big deal. This is the lowest it has been since late April. Other major tokens, like Solana (SOL-USD) and Dogecoin (DOGE-USD), also went down.

At the time of writing, BTC is sitting at $57,694.

BTC Technical Analysis

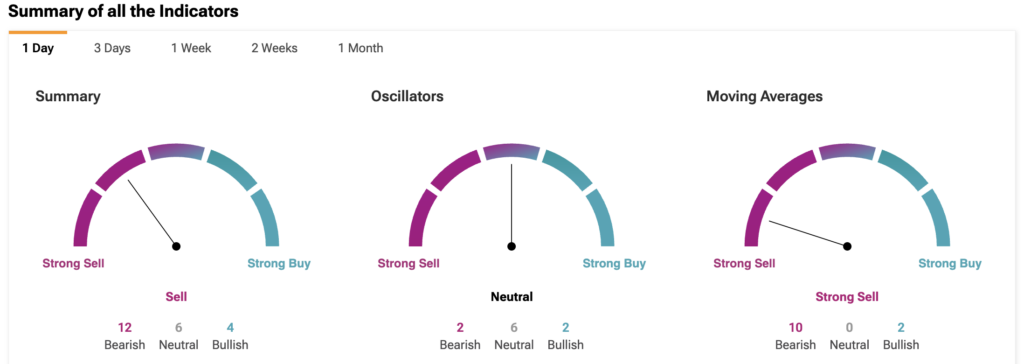

According to TipRanks’ Bitcoin Technical Analysis tool, Bitcoin’s moving averages indicate a Strong Sell. Bitcoin’s 100-day simple moving average is 65882.11, and the Bitcoin price currently is below this average, sitting at $57,694. This is a key number that many traders watch. When the price is below this average, it usually means the market is in a downtrend, or going down.

Alex Kuptsikevich, a market expert, thinks Bitcoin could drop to $51,500 soon. This is because traders use these trendlines to decide when to buy or sell.

What’s Next?

QCP Capital, a trading firm, expects the market to stay quiet for a while. This is because of the uncertainty around the Mt. Gox repayments. If Bitcoin’s price goes below $57,590, it could lead to even more selling .

In short, Bitcoin’s drop below $59,000 has made investors worried. The upcoming Mt. Gox repayments and potential miner sales could keep the market unstable. Traders should watch key price levels and be ready for more changes .