German sandals maker Birkenstock (NYSE:BIRK), renowned for its comfortable and durable footwear, is a relatively new addition to the stock market. Despite its recent debut as a publicly traded company in October of last year, Birkenstock features a brand with a two-century-old tradition and has experienced significant growth in recent years. While recent results have fueled robust bullish momentum for BIRK, it currently trades at much higher multiples than its peers and is potentially overvalued. This has led me to adopt a neutral stance on the stock.

Birkenstock’s Recent Journey Since IPO

Birkenstock is a solid brand with broad penetration in the U.S. and Europe. Its understated silhouette represents the culmination of two centuries of family expertise, revolutionary orthopedic design, and one of the business’s most unique, innovative, and sustainable footwear constructions.

This has fostered a fiercely loyal following of Birkenstock’s evangelists. As CEO Oliver Reichert said, “You’ve just got to try and survive the first visual influence, and then it is love on the second site.” While this may not be the most charming way of presenting a shoe brand to the world, it has yet been a significant factor in the company’s trajectory success.

Translating the brand’s power into numbers, Birkenstock has maintained an impressive revenue compound annual growth rate (CAGR) of 21% over the past decade (see the image below). More recently, between September 2020 and September 2023, the company nearly doubled its revenues, increasing from €728 million to €1.49 billion. Additionally, the firm has sustained a robust gross profit margin exceeding 60% since 2022.

With its silhouette sales booming and its aim of funding further growth, the next logical step was an IPO. Birkenstock made its stock market debut in October 2023, pricing its IPO at $46 per share and reaching a market value of close to $7.55 billion on its first trading day.

However, as Birkenstock started to release its first quarterly results as a public company, the market adjusted its valuation of the stock. After reporting Q4-2023 earnings in January of the following year, Birkenstock experienced a surge in its share price, only to falter as it failed to meet market estimates on earnings due to warning signs of margin pressures.

The trend continued into Q1 2024, where strong sales growth exceeded revenue estimates but fell short on EPS, leading to a sharp decline in its share price to as low as $41 per share in April.

However, recent Q2-2024 results on May 30 propelled Birkenstock forward. The results surpassed top- and bottom-line estimates, and the company raised full-year guidance. Shares rallied strongly toward $57.

In its first months on the stock market, Birkenstock shares have seen significant gains, accumulating over 50% since its IPO and now boasting a market cap above $10 billion.

Birkenstock’s Recent Stellar Results

Delving deeper into the company’s current position through its most recent results, it’s evident that Birkenstock is experiencing robust growth in demand for its products.

The Q2-2024 results were awe-inspiring. Revenues surged by 22% year-over-year to €481 million, while net profit soared by 45% year-over-year to €72 million. According to Birkenstock’s CEO, Oliver Reichert, this strong demand can be attributed to identifying significant “white space areas” across various geographies, channels, and categories.

It’s important to note that much of Birkenstock’s sales growth stemmed from its established products and markets. Revenues from the company’s core silhouettes experienced a 20% increase, emphasizing the brand’s strength and lasting relevance.

Interestingly, the positive growth results caught even the management team by surprise. Birkenstock has consequently raised its revenue growth guidance for Fiscal 2024 to 20%, up from the previous guidance of 17-18%. The gross profit margin guidance of approximately 60% has also been maintained.

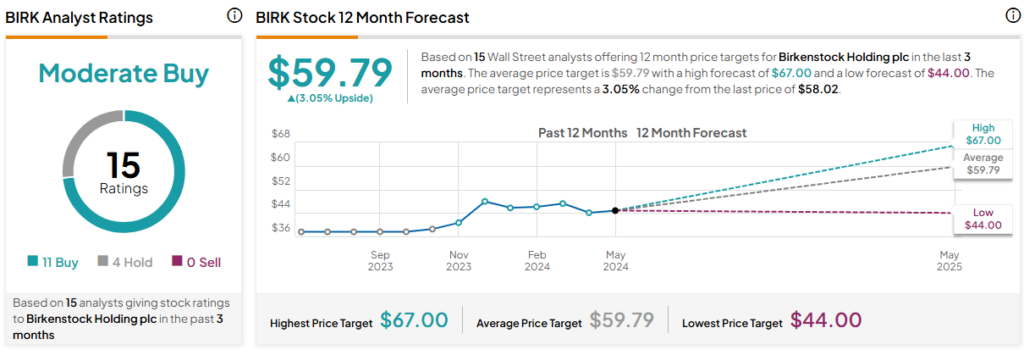

Thanks to their more absolute vision of growth, the markets saw the company’s valuation as justified, as shares surged by 10% following the release of the results. Wall Street analysts initiated a wave of price target increases.

Baird analyst Mark Altschwager, for instance, raised the firm’s price target on Birkenstock to $65 from $58, maintaining a Buy recommendation and highlighting the robust momentum of the Birkenstock brand across channels and geographies driven by compelling product innovation.

However, It’s Not All Sunshine and Rainbows

Despite the bullish momentum, sales growth, and robust margins, I still struggle to “pound the table” and lean have a neutral stance on Birkenstock stock.

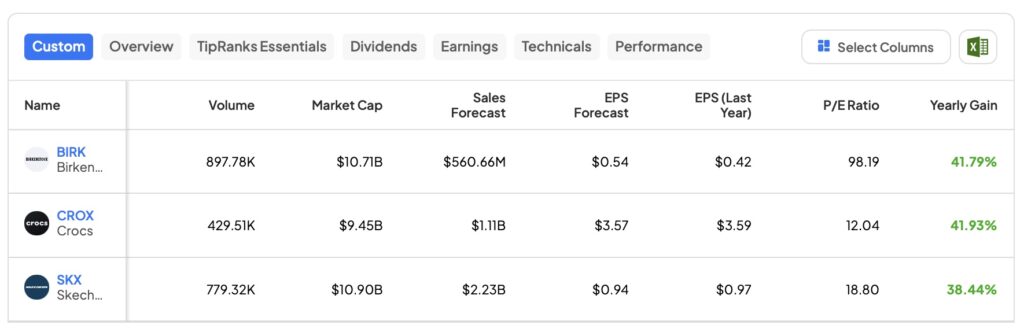

The major question mark hovering over the bullish thesis is precisely due to the stretched valuation multiple the stock has. Birkenstock currently commands a massive premium compared to its peers, boasting a price-to-sales (P/S) ratio of 6.1x and an EV/EBITDA ratio of 31.2x. These multiples far exceed the industry average of close to 1x and 10x, respectively. When we consider the company’s forward price-to-earnings (P/E) ratio, projecting a 13% bottom line yearly increase, even the 42x multiple seems irrational compared to direct peers such as Crocs (NASDAQ:CROX) and Skechers (NYSE:SKX).

One of the few skeptical analysts covering Birkenstock stock, Bank of America’s (NYSE:BAC) Lorraine Hutchinson, echoes this same concern. She maintains a Hold recommendation on the company, warning about longer-term risks that are not factored into the current valuation.

Sharing Hutchinson’s perspective, it does seem that there is an excess of optimism surrounding Birkenstock’s valuation based on short-term momentum.

It’s crucial to consider that the factory expansions, aimed at meeting the growing demand, may exacerbate the inflationary effects of consumer spending, which is still exhibiting signs of weakness as the second half of this year begins. This could potentially impact labor and raw material costs, posing a challenge to Birkenstock’s management’s optimistic margin guidance.

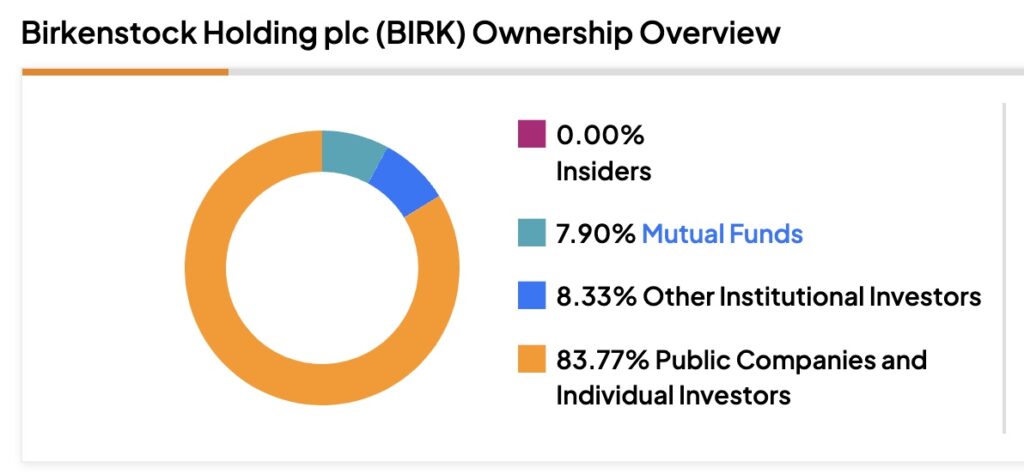

Another red flag that dampens a more bullish thesis on Birkenstock is the company’s status as a private-equity-owned entity. With over 80% of the company’s shares owned by private equity funds (81.1% solely owned by Catterton Management Company), the free float percentage available to the general public is very low. This limited liquidity makes it easier for large shareholders to influence the stock price by buying or selling a relatively small number of shares, potentially leading to price manipulation and distortions in the company’s valuation.

Is BIRK Stock a Buy, According to Analysts?

BIRK’s consensus rating is Moderate Buy, based on insights from 15 analysts offering price targets in the last 12 months, of which 11 recommend a Buy. The average BIRK stock price target is $59.79 per share, indicating upside potential of just 3.05%.

Conclusion

Birkenstock is not just a company with solid fundamentals. It’s also a powerhouse brand with a two-century-old tradition that has captured the market’s attention with its robust growth in recent years, a stellar performance in Q2 2024, and upbeat guidance for this year.

However, with valuation multiples significantly higher than its industry peers, the market may be overly optimistic about the company’s long-term growth prospects. This places Birkenstock in a scenario with little room for error in maintaining a valuation above $10 billion. Therefore, caution is warranted. As a result, I maintain a neutral stance on Birkenstock stock.