In 2020, biotechs have taken center stage. There are several biotech stocks that could generate stellar returns over the near future, according to Wall Street analysts. However, one should be aware that many of these stocks are risky as they are largely impacted by any news related to the development of their key drugs and regulatory approvals.

Bearing this in mind, we will use TipRanks’ Stock Comparison tool to place BioXcel Therapeutics and TG Therapeutics alongside each other and select the biotech stock offering higher returns. We are talking about over 100% upside potential here.

BioXcel Therapeutics (BTAI)

BioXcel is a clinical-stage biopharma company that uses artificial intelligence to develop drugs across the neuroscience and immuno-oncology spaces. Currently, the company is not generating any revenue as it does not have any approved drugs on the market. That said, analysts are keeping an eye on the company’s two lead candidates, BXCL501 and BXCL701.

BXCL501 is an orally dissolving thin film formulation of a popular sedative called Dexmedetomidine in late-stage development for the treatment of agitation resulting from neuropsychiatric disorders like schizophrenia and bipolar disorder. Meanwhile, BXCL701 is being developed for the treatment of a rare form of prostate cancer and pancreatic cancer in combination with other immuno-oncology agents.

On Dec. 7, BioXcel announced that it was awarded a grant by the U.S. Department of Defense to evaluate BXCL501 in patients suffering from post-traumatic stress disorder related to alcohol and substance abuse disorder. This will be the first time that BioXcel is investigating BXCL501 as a potential chronic treatment. (See BTAI stock analysis on TipRanks)

Weighing in on this recent update, H.C. Wainwright’s Ram Selvaraju stated, “Dex [Dexmedetomidine] is a full agonist with higher CNS [Central Nervous System] penetration and higher intrinsic activity at the receptor compared to the other alpha-2 receptor agonists, including clonidine and guanfacine, which are only partial agonists. BXCL501 could therefore be a valuable therapeutic option to reduce the hypersympathetic response in patients with PTSD and may have the potential to become a front-line chronic treatment option for PTSD patients.”

BXCL501 has been granted fast track designation by the FDA for the acute treatment of agitation in patients with schizophrenia, bipolar disorders and dementia. Following favorable results from the Phase 3 Serenity trials, the company completed a successful pre-NDA (New Drug Application) meeting with the FDA for BXCL501 for the acute treatment of agitation in patients with schizophrenia and bipolar disorders. What’s more, the FDA agreed to a rolling review of the NDA, with the company already submitting part of the NDA. BTAI plans to submit the complete application in 1Q21.

Selvaraju believes that BXCL501 could be approved in the U.S. by the end of 2021 or early 2022, assuming an on-time NDA submission. The 5-star analyst drew investors’ attention to the fact that BXCL501 is also being developed to treat acute delirium in hospitalized patients, including COVID-19 patients. Given multiple additional applications for BXCL501, Selvaraju sees a rich pipeline in a single drug candidate, and hence, reiterated a Buy rating with a price target of $175 (upside potential of 306%).

Currently, the Street’s average price target of $115 hangs below Selvaraju’s estimate but still indicates an attractive upside potential of about 167% in the months ahead. Shares have already risen by a whopping 195% year-to-date. Overall, BioXcel scores a Strong Buy analyst consensus based on 3 unanimous Buys.

TG Therapeutics (TGTX)

TG Therapeutics is a biopharma company focused on the development of novel treatments for B-cell malignancies and autoimmune diseases. TGTX shares have exploded over 280% so far this year in reaction to many favorable pipeline updates.

Currently, the company’s two investigational compounds, ublituximab and umbralisib (the combination of which is referred to as U2) are in Phase 3 clinical development for patients suffering from hematologic malignancies, with ublituximab also in Phase 3 clinical development for multiple sclerosis.

Shares spiked 41% on Dec. 10 as the company announced positive results from its Ultimate I and II Phase 3 studies evaluating Ublituximab monotherapy for multiple sclerosis treatment. TG Therapeutics disclosed that both studies met their primary endpoints, with ublituximab demonstrating a statistically significant reduction in annualized relapse rate over a 96-week period.

The company stated that further analyses of the Ultimate I and II studies, including safety and secondary endpoints, will be conducted and detailed data will be presented at an upcoming medical congress in the first half of 2021. Additionally, it expects data from these studies to support a Biologics License Application (BLA) submission for ublituximab in multiple sclerosis, targeted in mid-year 2021.

The favorable update prompted H.C. Wainwright analyst Edward White to significantly raise his price target to $61 from $38. The five-star analyst reiterated a Buy rating on TG Therapeutics as he sees an increased probability of success for ublituximab in multiple sclerosis.

In a research note to investors, White stated, “That the trials are being conducted under an SPA [Special Protocol Agreement] gives us more confidence that the BLA will be successful. We do not expect any issues regarding CMC as the company is already submitting that section to the FDA with the submission for CLL. Importantly, TG plans to strategically price ublituximab to enhance patient access.”

“TG is currently in the early stages of talking with payors. We continue to expect ublituximab to take market share due to its more convenient infusion time. For ublituximab in MS, we estimate sales of $36M in 2022 and $601M in 2028,” White added. (See TGTX stock analysis on TipRanks)

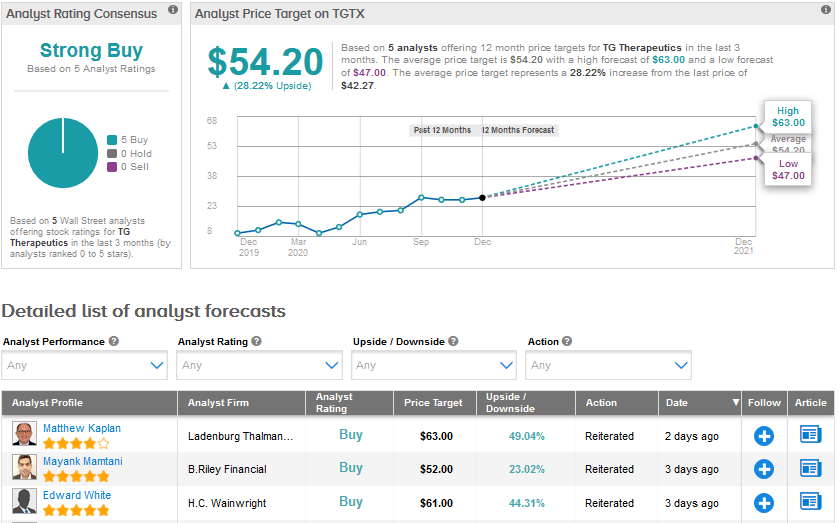

The Street mirrors White’s optimism, with a Strong Buy analyst consensus backed by 5 unanimous Buys. Given the meteoric rise in the stock, the price target of $54.20 implies an upside potential of 28.2% over the coming year.

Conclusion

Clearly, the Street’s outlook on BioXcel and TG Therapeutics is very bullish based on optimism surrounding their lead candidates. However, the triple-digit upside potential in BioXcel stock makes it a more compelling pick than TG Therapeutics. A word of caution for investors would be to consider all risks associated with investing in emerging biotech stocks, including the failure of obtaining regulatory approvals for promising drugs, funding requirements and competition from pharma giants.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment