The global biotechnology company Biogen, Inc. (BIIB) and Eisai, Co. Ltd, a pharmaceutical company based in Japan, received accelerated approval from the FDA for ADUHELM, a pathbreaking treatment for Alzheimer’s disease. Shares soared 38.3% to close at $395.85 on June 7.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

ADUHELM (aducanumab-avwa) has proven to reduce amyloid beta plaques, a biomarker that predicts a reduction in clinical decline. In clinical trials, these plaques were reduced in the brain by 59 to 71 percent at 18 months of treatment.

As part of the accelerated approval, Biogen will conduct a controlled trial to verify the clinical benefit of ADUHELM in patients with Alzheimer’s disease. (See Biogen stock analysis on TipRanks)

The drug is said to have certain adverse symptoms in patients including ARIA (Amyloid Related Imaging Abnormalities), confusion, dizziness, visual disturbances, and nausea.

Michel Vounatsos, CEO at Biogen said, “This historic moment is the culmination of more than a decade of ground-breaking research in the complex field of Alzheimer’s disease. We believe this first-in-class medicine will transform the treatment of people living with Alzheimer’s disease and spark continuous innovation in the years to come”

On receiving FDA approval, both Biogen and Eisai also announced a range of programs to support access for all qualified patients, including traditionally underserved communities. The companies are said to be in talks with the likes of Veterans Health Administration (VHA), CVS Health, and The National Association of Free and Charitable Clinics (NAFC) to focus on health disparities in these communities.

With Cigna Corporation, Biogen has entered into a value-based contract for easy access to treatment for the patients.

Additionally, Biogen and Eisai have committed to not increase the price of ADUHELM for the next four years.

Following the approval, Raymond James analyst Steven Seedhouse upgraded the stock to a Hold and said, “The extremely high tail risk from the confirmatory study, which we think will limit the stock multiple in the face of a return to top and bottom line growth near term is why we aren’t upgrading past Market Perform.”

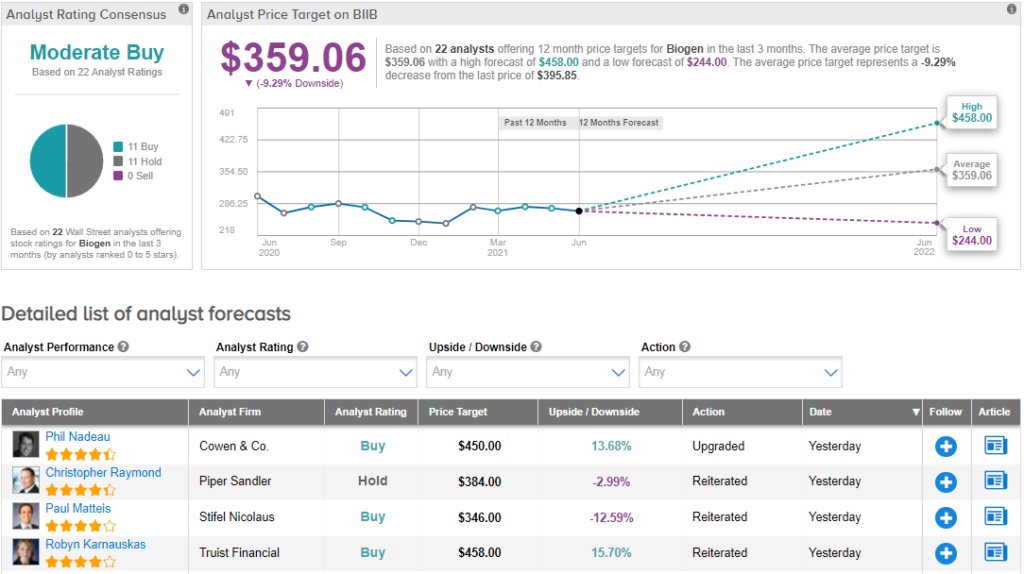

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 11 Buys and 11 Holds. The Biogen average analyst price target of $359.06 implies 9.3% downside potential to current levels. Shares have gained 62.9% year-to-date.

Related News:

UiPath Earnings Preview: Here’s What to Watch For

Fisker Planning to Deliver Climate Neutral Vehicle by 2027

Autodesk Proposes to Snap up Altium Limited; Shares up 3.8%