Biogen Inc. (NASDAQ: BIIB), one of the leading global Biotech stocks, and Japan-based global pharmaceutical company Eisai Co., Ltd. have revealed that lecanemab has been granted Fast Track designation by the U.S. Food and Drug Administration (FDA). Lecanemab, an investigational anti-amyloid beta (Aβ) protofibril antibody, is designed to treat early Alzheimer’s disease (AD).

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score a data driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Markedly, in June 2021, the antibody treatment was also granted Breakthrough Therapy designation by the FDA.

Other Approvals

In September 2021, a Biologics License Application (BLA) was submitted to the FDA for lecanemab based on clinical, biomarker, and safety data from the Phase 2b clinical study (Study 201). The trial included participants with early AD and confirmed amyloid pathology.

Additionally, the lecanemab Clarity AD Phase 3 clinical study in early AD is ongoing and completed enrollment in March 2021 with 1,795 patients. Notably, another Phase 3 clinical study, AHEAD 3-45, to evaluate the efficacy of treatment with lecanemab in patients suffering from preclinical AD and higher amyloid, is ongoing.

Wall Street’s Take

Recently, Bank of America Securities analyst Geoff Meacham maintained a Hold rating on the stock and decreased the price target to $275 (16.82% upside potential) from $295.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 15 Buys and 11 Holds. The average Biogen price target of $334.09 implies 41.92% upside potential. Shares have lost 3.6% over the past year.

Risk Analysis

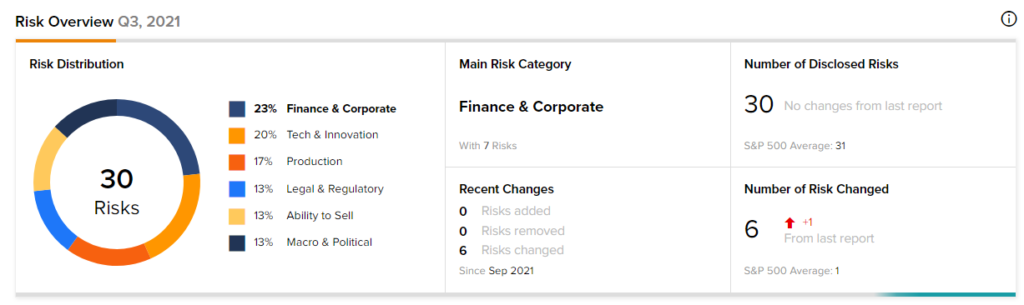

According to the new TipRanks Risk Factors tool, Biogen stock is at risk mainly from three factors: Finance and Corporate, Tech and Innovation, and Production, which contribute 23%, 20%, and 17%, respectively, to the total 30 risks identified for the stock.

Related News:

Citigroup to Vend Philippines Consumer Bank

Tencent to Reduce Stake in JD.com to 2.3%; Shares Slide

Quidel to Acquire Ortho for $6B; Shares Slide 17%