Biopharmaceutical company Biogen Inc. (BIIB) reported mixed fourth-quarter results with earnings missing and revenue beating expectations.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Following the results and lower than expected FY22 guidance, shares hit an all-time low of $212.56 during the intraday trading session and ended the day down 2.1% at $220.17 on February 3. Year-to-date, its shares have lost 9.8% in value.

Mixed Results

Biogen’s adjusted earnings came in one cent lower than the consensus estimates at $3.39 per share. However, the number was much better than the prior year’s adjusted loss of $1.05 per share.

On a positive note, Q4 revenue of $2.73 billion outpaced the Street estimates of $2.62 billion but dropped 4% compared to the same period last year.

For the full year of Fiscal 2021, adjusted earnings stood at $19.22 per share, lower than the $24.13 per share reported in FY20. Similarly, FY21 revenue declined 18% year-over-year to $10.98 billion.

CEO Comments

Commenting on the results, CEO Michel Vounatsos said, “Biogen continued to execute well in the fourth quarter despite the challenges we have faced… We have introduced the first FDA-approved treatment for Alzheimer’s disease in nearly 20 years, and we are engaging with the Centers for Medicare and Medicaid Services with the hope of finding a path for immediate patient access.”

Weak FY22 Outlook

Based on the declining sales trend from a couple of its drugs, namely Rituxan and Tecfidera, as well as limited National Coverage Determination (NCD) of its Alzheimer’s drug Aduhelm, the company has provided a conservative outlook for Fiscal 2022.

FY22 revenue is projected between $9.7 – $10 billion, much lower than the consensus estimate of $10.87 billion.

Similarly, FY22 adjusted earnings are forecast between $14.25 – $16 per share, also lower than the consensus estimate of $19.18 per share.

Important Business Updates

In January 2022, Biogen agreed to sell its equity stake in the Samsung Bioepis joint venture to Samsung Biologics for a total of $2.3 billion. The deal is expected to close in mid-2022, subject to certain regulatory conditions.

Regarding Aduhelm, in January the Centers for Medicare & Medicaid Services (CMS) proposed limited usage of BIIB’s anti-amyloid drug ADUHELM to cover only those individuals who are enrolled in the approved clinical trials. Final approval is expected to be issued in April 2022. In Q4, Biogen reported modest sales of Aduhelm of just $1 million.

Analysts’ View

Responding to Biogen’s quarterly performance, Needham analyst Ami Fadia reiterated a Buy rating on the stock with a price target of $292, which implies 32.6% upside potential to current levels.

Fadia noted that Biogen’s Q4 EPS came in line with consensus estimates and 2% above her estimates. The analyst expects the stock to fall on the weaker-than-expected results and poor FY22 guidance.

Fadia said, “We expect the base business to decline at an ~8% CAGR from 2020 to 2026 driven by erosion of the company’s multiple sclerosis franchise and we believe this is well understood by the Street. We estimate Biogen’s deep pipeline can drive risk-adjusted sales of ~ $2.5B in 2026, while the Street assigns minimal value to it.”

The analyst further added, “We include Aduhelm at a ~20% Point of Sales in our model to reflect the CMS draft coverage decision. Any improvement in coverage in the final decision would be upside to Street expectations.”

Overall, the stock has a Moderate Buy consensus rating based on 14 Buys and 13 Holds. The average Biogen price target of $283.05 implies 28.6% upside potential to current levels.

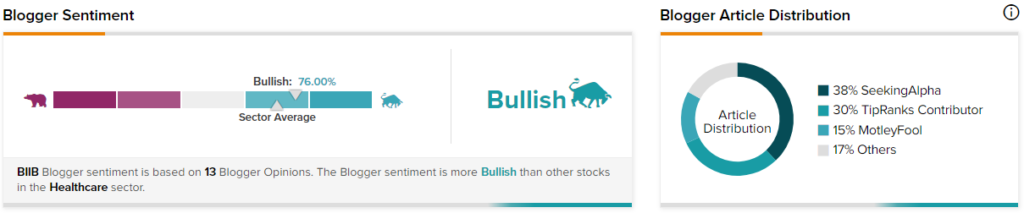

Blogger Opinions

TipRanks data shows that financial blogger opinions are 76% Bullish on BIIB, compared to the sector average of 70%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Spotify Beats Q4 Revenue; Shares Drop 10%

Amazon to Create 1500 Apprenticeship in the UK in 2022 – Report

Ford Post Record-Breaking January Sales