Shares of China-based online entertainment service provider Bilibili (BILI) declined 3.6% in Thursday’s early trade despite its strong performance in the second quarter of 2021.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Adjusted net loss per share came in at RMB2.23 ($0.35), less than the consensus estimate of a loss of RMB2.89 ($0.46). The company had reported a loss of RMB1.35 ($0.22) in the same quarter last year.

Bilibili reported Q2 revenues of RMB4.5 billion ($696.2 million), up 72% from the year-ago quarter. It also came above the Street’s estimate of RMB4.3 billion. The upside was primarily due to a 98% rise in revenues from value-added services, along with a 201% surge in advertising revenues. Revenues from E-commerce and others increased 195%.

Bilibili’s average monthly active users jumped 38% year-over-year to 237.1 million. Also, average monthly paying users increased 62% to 20.9 million. (See Bilibili stock charts on TipRanks)

For the third quarter of 2021, the company expects net revenues to be between RMB5.1 billion and RMB5.2 billion.

On August 13, Deutsche Bank analyst Leo Chiang initiated coverage on the stock with a Buy rating and a price target of $110 (upside potential of 60.7%).

Consensus among analysts is a Strong Buy based on 7 unanimous Buys. The average Bilibili price target stands at $134.83, implying 97% upside potential.

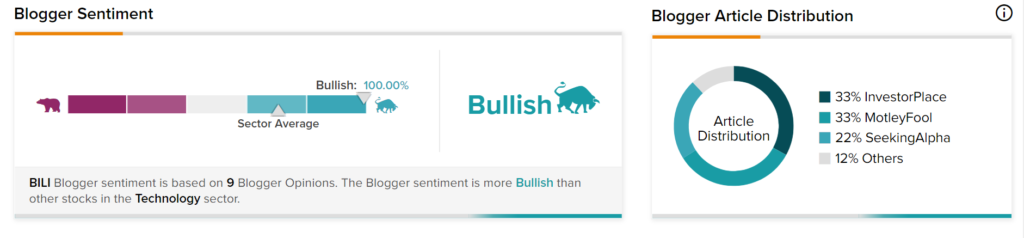

TipRanks data shows that financial blogger opinions are 100% Bullish on BILI, compared to the sector average of 70%.

Related News:

Lumentum Delivers Better-Than-Expected Q4 Results, Provides Guidance

Overstock to Repurchase $100M Common Stock; Analysts Remain Bullish

Landstar Raises Guidance for Q3 on Positive Trend