Shares of open SaaS eCommerce platform BigCommerce Holdings (NASDAQ:BIGC) are trending higher today after the company highlighted promising trends for the holiday season. BIGC caters to both new-age and established B2C and B2B brands.

On a same-store basis, BigCommerce stores witnessed a 14% jump in gross merchandise value (GMV) on Thanksgiving day compared to the prior year. Further, the number of total orders increased by 5%, and the average order value (AOV) increased by 8%.

Add to this, on Black Friday, customer GMV increased by 6%, and the number of total orders ticked higher by 5%. Impressively, the company clocked an average sitewide checkout conversion of 61.4% for enterprise customers using its solutions.

The National Retail Federation (NRF) expects holiday sales in the U.S. to be in the range of $957.3 billion and $966.6 billion. As companies across the board vie to make the most from the holiday season, Amazon (NASDAQ:AMZN) could dominate eCommerce holiday sales given its value pricing and efficient delivery infrastructure.

Is BigCommerce a Good Investment?

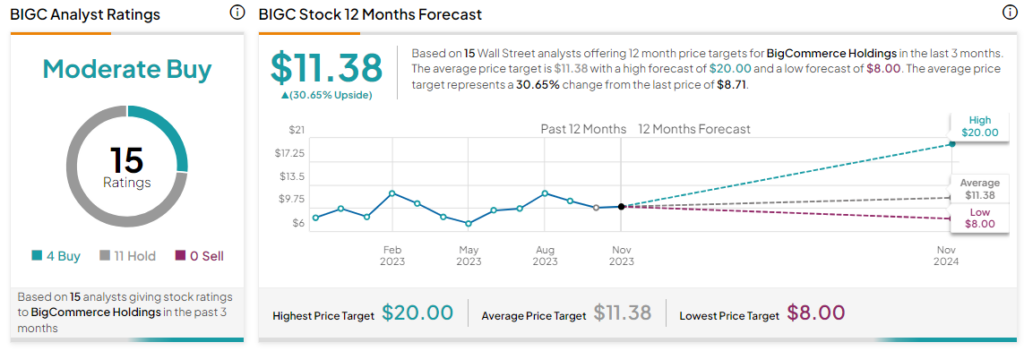

Overall, the Street has a Moderate Buy consensus rating on BigCommerce. Following a nearly 10.2% rise in its shares over the past six months, the average BIGC price target of $11.38 implies a 30.6% potential upside.

Read full Disclosure