Big Lots, Inc. (BIG) reported stronger-than-expected Q1 results, topping both earnings and revenue estimates, driven by results from the strategic initiative Operation North Star and third stimulus distributions. Shares of Big Lots declined 5.5% on Friday as due to a lack of visibility, the company refrained from providing FY2021 guidance.

However, it did lay out its expectation plans for the second quarter of the year. EPS is expected to range between $1.00 and $1.15. Comparable sales are forecast to decline by a low double-digit indicating a two-year stacked comparable sales increase of around 20%.

The company reported earnings of $2.62 per share in Q1, beating analysts’ expectations of $1.69 per share. Revenues of $1.63 billion exceeded the consensus estimate of $1.53 billion.

Notably, earnings per share more than doubled compared to earnings of $1.26 per share reported in the same quarter last year. Net sales grew 13% on a year-over-year basis driven by strong growth of 11.3% in comparable sales and higher sales from new and relocated non-comp stores.

The company bought back 1.1 million shares worth $78 million at an average price of $67.45. The remaining authorization for repurchases is $250 million. (See Big Lots stock analysis on TipRanks)

Big Lots CEO Bruce Thorn commented, “Our outstanding results for the quarter were achieved despite significant supply chain and freight headwinds, which we expect to continue through the balance of the year.”

Thorn further added, “We are taking other important steps to strengthen our business. These include rolling out our forward distribution center strategy to relieve pressure at our regional distribution centers and more efficiently process bulk items such as furniture; strengthening our vendor partnerships to create even greater value for our customers and improve assortment availability; and investing in data-driven space planning technology designed to enhance our customer satisfaction and per-store productivity through more relevant location- based assortments.”

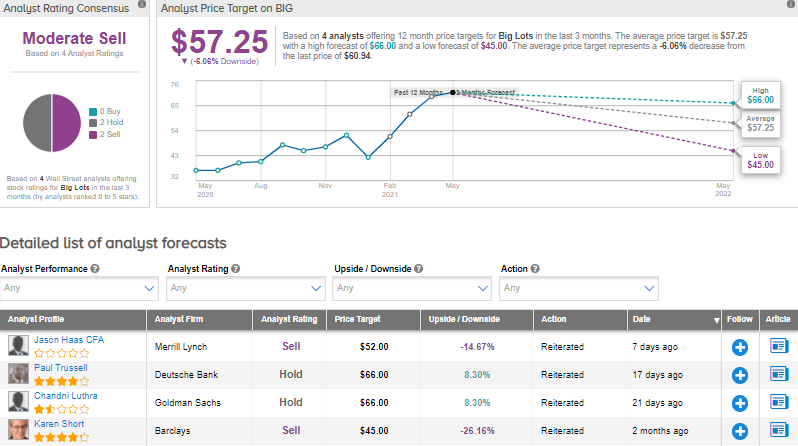

On May 24, Merrill Lynch analyst Jason Haas reiterated a Sell rating and increased the price target from $44 to $52 (14.7% downside potential) on the stock.

Overall, the stock has a Moderate Sell consensus rating based on 2 Holds and 2 Sells. The average analyst price target of $57.25 implies 6.1% downside potential from current levels.

Related News:

Nutanix Posts Smaller-Than-Feared Quarterly Loss, Revenue Beats Estimates

Medtronic Posts a Blowout Quarter as Revenue Outperforms, Bumps up Dividend

Sanofi and GSK Commence Phase 3 Study of COVID-19 Vaccine Candidate