Baidu (BIDU) reported mixed results for the second quarter. The Chinese search giant posted flat revenues of RMB33.9 billion ($4.66 billion), falling short of the consensus estimate of $4.76 billion. However, the company reported adjusted earnings of RMB21.02, or $2.89 per American Depository Share (ADS), exceeding Street expectations of $2.59 per share.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

BIDU’s Revenue Decline Reflects China’s Economic Slowdown

Digging deeper into the results, the company’s flat revenues were significantly influenced by the challenging macroeconomic environment in China. Baidu’s online marketing business, which constitutes the bulk of its revenue, saw a 2% decline to RMB19.2 billion. This decrease highlights the effects of a slowing Chinese economy, which has prompted advertisers to tighten their budgets.

Baidu Increases Focus on AI

Meanwhile, despite these revenue challenges, Baidu has significantly increased its investment in AI and other advanced technologies as part of its transformation into what it now calls an “AI company.” Ernie, Baidu’s large language model platform positioned as a competitor to OpenAI’s GPT, has been integrated into various app services to enhance user experience.

In addition to these AI advancements, the company has also introduced a paid version of its Ernie-powered chatbot for public use while offering application programming interface (API) services powered by Ernie to developers through its cloud computing platform.

Baidu Expands Apollo Go Service

Continuing its focus on AI-driven innovation, Baidu has also intensified its investment in autonomous vehicles. Its Apollo Go robotaxi service is now operational in multiple Chinese cities, with the largest fleet of 500 vehicles running in Wuhan.

Building on this expansion, in the second quarter, Apollo Go provided around 899,000 rides, up 26% year over year. As of July 28, 2024, the cumulative rides provided to the public by Apollo Go surpassed 7 million. Furthermore, Baidu has projected that Apollo Go’s operations in Wuhan will break even by the end of this year.

Looking to the future, the company also stated that the sixth generation of its autonomous vehicle, the RT6, is now undergoing testing.

Is BIDU Stock a Buy?

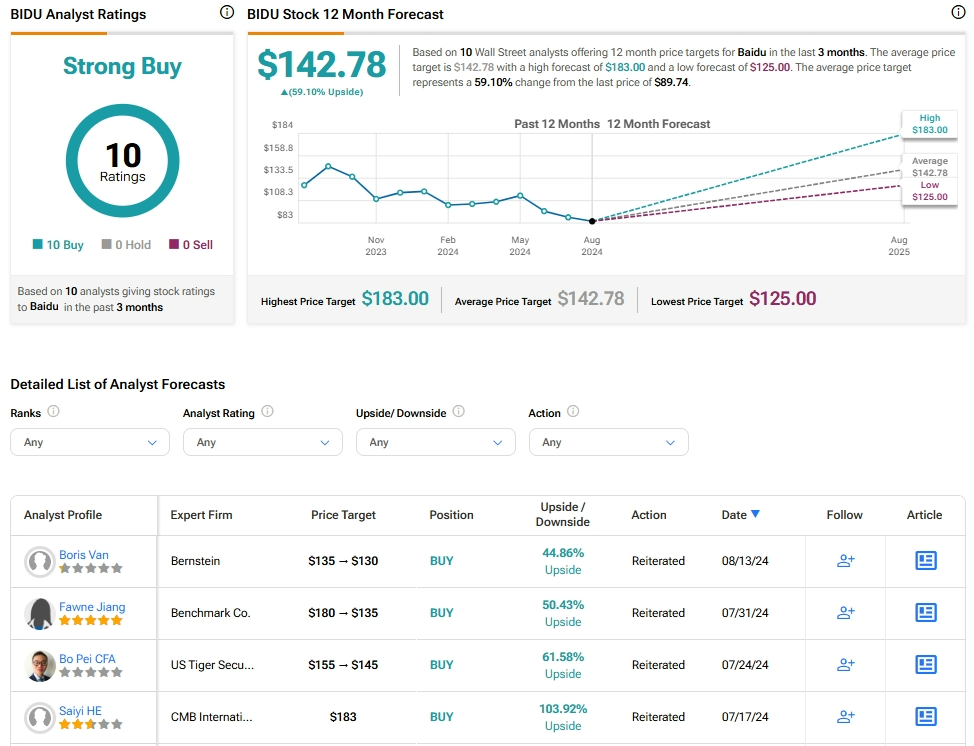

Analysts remain bullish about BIDU stock, with a Strong Buy consensus rating based on a unanimous 10 Buys. Over the past year, BIDU has declined by more than 25%, and the average BIDU price target of $142.78 implies an upside potential of 59.1% from current levels. These analyst ratings are likely to change following BIDU’s results today.