Plant-based meat pioneer Beyond Meat (BYND) announced that it will this month introduce a cheaper product line sending shares up 5% on Wednesday.

The stock rose 5% to $159.56 in early afternoon U.S. trading. Starting in the week of June 22, Beyond Meat will begin to sell value packs with 10 plant-based patties costing half the price of its current products. The limited edition plant-based burger 10-pack will be available at a majority of Walmart (WMT)and Target (TGT) stores and select U.S. retailers.

“With summer grilling season underway, we are pleased to launch Cookout Classic value packs nationwide at our most affordable price point to date,” Beyond Meat’s Founder and CEO Ethan Brown said. “This forward-looking pricing represents an important milestone along our journey to make Beyond Meat more accessible to all consumers.”

Credit Suisse analyst Robert Moskow believes that Beyond’s retail growth rate will remain high now that it has launched a 10-pack in the freezer aisle at half the price/lb of its normal 2-pack.

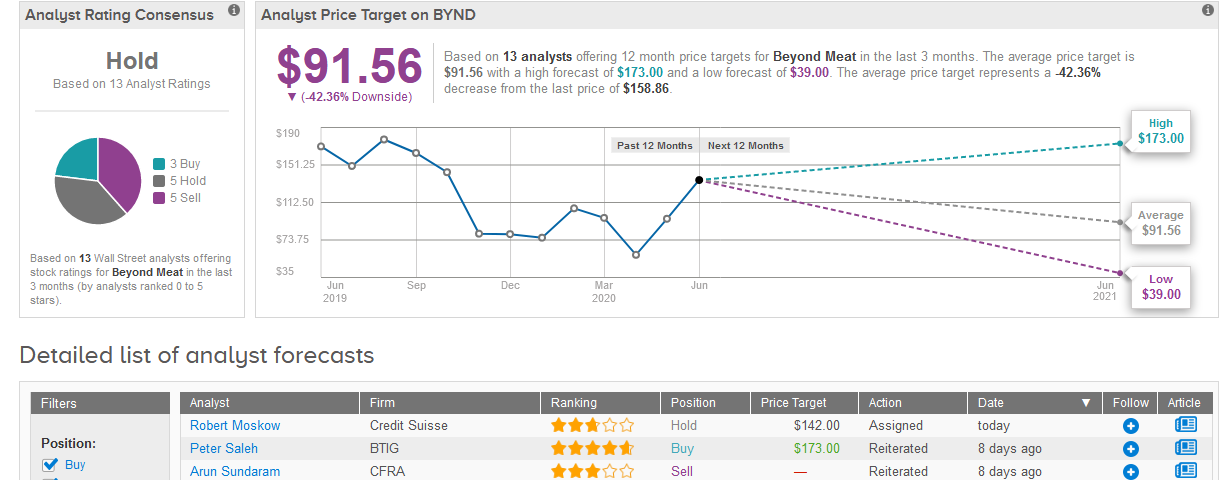

In recent months, Beyond Meat has landed a number of international expansion deals, which have helped the value of its share price almost triple since mid-March. Following the impressive rally, the $91.56 average analyst price target now indicates 42% downside potential from current levels. (See Beyond Meat stock analysis on TipRanks)

Meanwhile, Credit Suisse’s Moskow boosted the stock’s price target to $142 from $90, saying that the company may emerge as a “net beneficiary” of the pandemic in the near-term due to strong retail demand.

“We think the spike in at-home consumption will lead to stronger sales at restaurant chains as social restrictions ease off,” Moskow wrote in a note to investors.

In the long-term, Beyond Meat is bound to benefit from growing consumer interest in healthier foods since the start of the pandemic as people are interested in boosting their resilience to illness, Moskow added. However, the analyst still maintains a Hold rating on the stock due to valuation.

In line with Moskow the rest of Wall Street analysts remain sidelined on Beyond Meat’s stock right now. The Hold analyst consensus is divided into 5 Hold and 5 Sell ratings versus 3 Buy ratings.

Related News:

Beyond Meat Teams Up With KFC, Pizza Hut In China

Just Eat Takeaway.com To Snap Up Grubhub For $7.3 Billion

Beyond Meat (BYND) Remains Promising, but the Stock Is Too Expensive