Beyond Meat (BYND) will for the first time start to sell its plant-based meat patties in supermarkets in mainland China through a partnership with Alibaba’s (BABA) Freshippo grocery stores.

Retail sales of the plant-based burgers will start this weekend at 50 Freshippo stores in Shanghai. From September, the sales exposure will be extended to 48 more stores in Beijing and Hangzhou. The burgers will also be available for orders on Freshippo’s mobile app for delivery.

“We know that retail will be a critical part of our success in China, and we’re pleased to mark this early milestone within a few months of our market entry,” Beyond Meat CEO Ethan Brown said in a statement.

The announcement further strengthens Beyond Meat’s foothold in China. Back in April, the plant-based meat provider made the foray into the market in China announcing a partnership with Starbucks (SBUX). The company also teamed up with Yum China Holdings (YUMC), which operates fast-food chains Kentucky Fried Chicken (KFC) and Pizza Hut, to sell Beyond Meat products in China.

In addition, Beyond Meat last month announced a partnership with Sinodis, a food distributor, which delivers imported products to more than 4500 wholesalers, restaurant chains, and hotels in China.

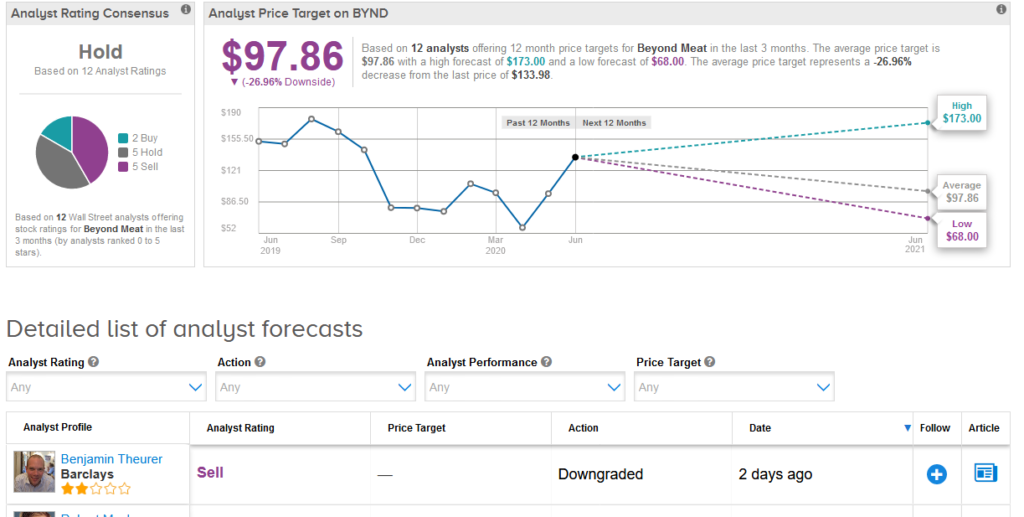

The Asia expansion deals have helped the value of the company’s share price to more than double since mid-March. Following the impressive rally, the $97.86 average analyst price target now indicates 27% downside potential from current levels. (See Beyond Meat stock analysis on TipRanks)

Shares rose 1.8% to $133.98 at the close of trading on Tuesday.

Credit Suisse analyst Robert Moskow earlier this month boosted the stock’s price target to $142 from $90, saying that the company may emerge as a “net beneficiary” of the pandemic in the near-term due to strong retail demand.

“We think the spike in at-home consumption will lead to stronger sales at restaurant chains as social restrictions ease off,” Moskow wrote in a note to investors.

In the long-term, Beyond Meat is bound to benefit from growing consumer interest in healthier foods since the start of the pandemic as people are interested in boosting their resilience to illness, Moskow added, while maintaining a Hold rating on the stock due to valuation.

In line with Moskow the rest of Wall Street analysts remain sidelined on Beyond Meat’s stock right now. The Hold analyst consensus breaks down into 5 Hold and 5 Sell ratings versus 2 Buy ratings.

Related News:

Beyond Meat To Sell Cheaper Plant-Based Burgers Ahead Of Summer Season; Stock Jumps 5%

Beyond Meat Teams Up With KFC, Pizza Hut In China

Beyond Meat (BYND) Is a Winner, but the Stock Is Fairly Valued Here, Says Analyst