The ‘shoot for the stars’ mentality of Elon Musk can serve as a lightning rod, attracting both adoration and disdain. And yet, whether one likes it or not, Tesla’s (NASDAQ:TSLA) prospects are intrinsically tied to the enigmatic CEO’s vision.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Take Tesla’s Robotaxi project, for example. Musk envisions a fleet of autonomous Teslas that owners can deploy to transport passengers when not in use, creating a new revenue stream for the company.

Against this backdrop, an investor known as Stone Fox Capital argues that any real evaluation of Tesla must consider the likelihood of another Musk-driven breakthrough.

“As usual, CEO Elon Musk is building for the future and not stuck on the current results,” SCF notes, expressing optimism about the potential of a TSLA robotaxi fleet, which he sees as a venture with “huge upside potential.”

Though the investor admits that there are plenty of technical and regulatory hurdles standing in the way, this has not stopped Musk in the past. “While many questions exist on the timing and volumes of a Tesla robotaxi service, Elon Musk has a history of pushing for big plans and eventually succeeding,” SCF explained.

In the here and now, the investor points to healthy tidings, such as the company’s plan to produce three million vehicles in 2025 (an increase of 50%).

Still, the big rewards will be for those investors who can patiently wait for Musk’s longer-term bets to pay off. SCF believes that Tesla has put together a roadmap to obtain 5x to 10x revenues in the next five years and beyond.

“The next revenue breakthrough likely comes from the eventual launch of robotaxis,” believes SCF. “Our view is that the company is on the verge of the next level higher.”

With this conviction, Stone Fox Capital rates Tesla shares a Buy. (To watch Stone Fox Capital’s track record, click here)

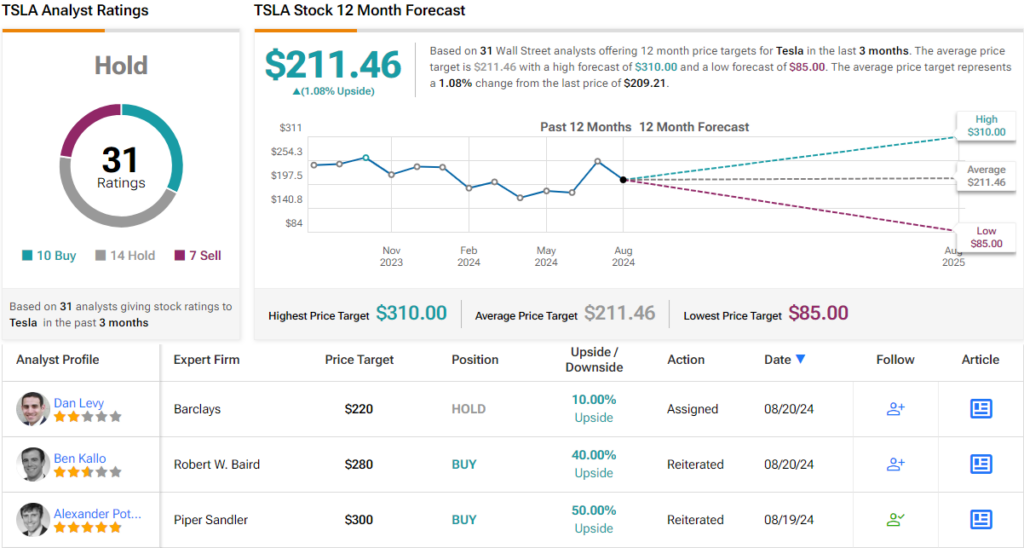

Not everyone on the Street shares SFC’s enthusiasm. In fact, TSLA’s Moderate Buy consensus rating is based on 10 Buys, 14 Holds, and 7 Sells. Going by the $211.46 average price target, the shares will stay rangebound for the time being. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.