Shares in Best Buy Co (BBY) soared 5% in extended market trading on Tuesday after the company reported that sales this quarter through July 18 rose by about 2.5% year-on-year fueled by strong online sales growth for its electronic devices and appliances.

The stock spiked to $94.75 in Tuesday’s after-market trading. Online sales quarter-to-date through July 18, jumped 255% compared to the prior year. The largest sales growth drivers were computing, appliance and tablet products, the company said. Since Best Buy started reopening stores for shopping in mid-June, revenue increased by about 15% compared to the prior year and online sales remained strong with revenue growth of about 185% year-on-year.

“Strong consumer demand, combined with shopping experiences that emphasize safety and convenience, has helped produce our sales results to date,” Best Buy CEO Corie Barry said. “In the early days of the COVID-19 crisis, we made a number of temporary decisions, including providing appreciation pay to hourly field employees, and we’re now pleased to evolve to a more structural approach that significantly invests in paying and supporting them in ways that they have asked for and so clearly earned.”

Best Buy announced that it plans to raise hourly wages for its employees by 4%. From Aug. 2, the company will replace its incentive pay scheme it implemented during the coronavirus pandemic. The starting wage will be increased to $15 per hour.

On June 15, Best Buy began allowing customers to shop without an appointment at more than 800 stores across the U.S. As of June 22, almost all of the company’s stores were open for shopping. It has also continued to offer contactless curbside pickup and in-store consultations.

Since hitting a low in March, shares have almost doubled and are now trading 2.8% higher than at the start of the year.

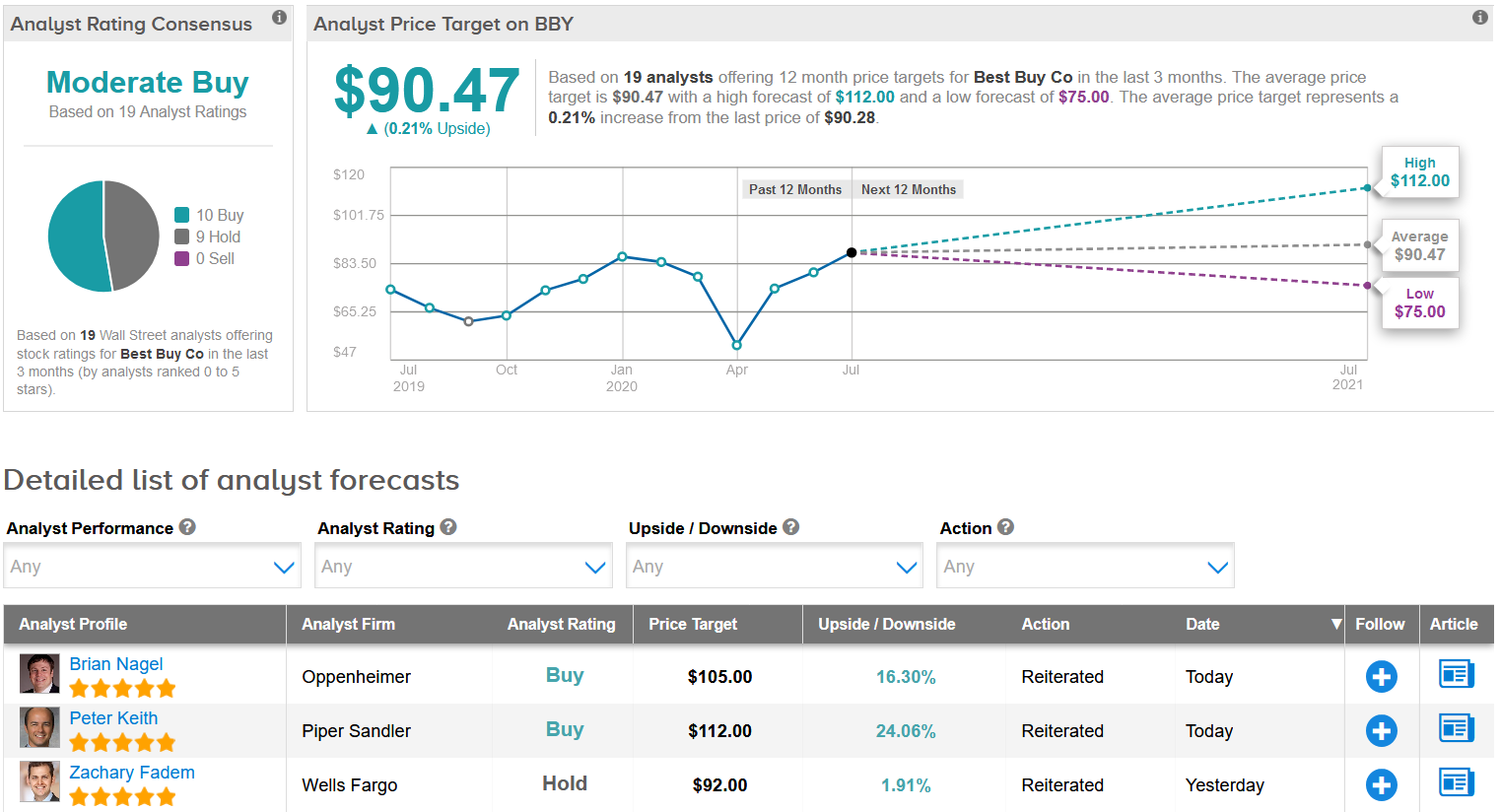

The “significant sales rebound” prompted Oppenheimer analyst Brian Nagel to lift the stock’s price target to $105 (16% upside potential) and reiterate a Buy rating.

“The company’s increasingly powerful and well-developed omni-channel infrastructure will allow BBY to serve customers well and continue to capture share in the still-fragmented and inefficient market for consumer electronics,” Nagel wrote in a note to investors.

The rest of the Street is cautiously optimistic on the stock’s outlook with a Moderate Buy analyst consensus. The $90.47 average analyst price target suggests shares are almost fully valued. (See BBY stock analysis on TipRanks)

Related News:

Texas Instruments Provides Upbeat Sales Outlook; Top Analyst Sees 18% Upside

Logitech Ramps Up Annual Profit Outlook As Q1 Income Leaps 75%

Synaptics Snaps Up DisplayLink For $305M In All-Cash Deal; Top Analyst Lifts PT