American consumer electronics retailer Best Buy Inc. (BBY) delivered better-than-expected third-quarter results. Despite the ongoing supply chain problems, the company managed to beat expectations on both its top and bottom lines with effective execution and management.

However, shares plummeted 12.3% as the management warned of margin compression from rising thefts. Investors were also disappointed with the conservative Q4 guidance despite the holiday season. Shares closed at $121.01 on November 23.

Better-Than-Expected Results

The company reported earnings of $2.08 per share, up a modest 1% against the prior-year quarter, and 18 cents higher than analysts’ estimates of $1.90 per share.

Furthermore, revenue remained relatively flat at $11.91 billion, outpacing analysts’ estimates of $11.56 billion.

Compared to Q3FY21, Best Buy’s Domestic comparable sales increased 2% driven by sales of Appliances, Home Theatre, and Mobile Phones, and partially offset by a fall in computing sales. Meanwhile, International comparable sales declined 3% in Canada, and the segment took a revenue hit due to its exit from Mexico.

Management Comments

Best Buy CEO, Corie Barry, said, “Our omnichannel capabilities and our ability to inspire and support across all of technology in a way no one else can means we are uniquely positioned to seize the opportunity in this environment and in the future.”

The CEO added, “More people continue to sustainably work, entertain, cook and connect at home, and while customers are returning to stores, digital sales were still more than double pre-pandemic levels, and phone, chat, and in-home sales continued to grow.”

See Analysts’ Top Stocks on TipRanks >>

Guidance

Looking forward to a strong holiday season with continued investments in the new membership program, technology, advertising, and health strategy, BBY gave the following outlook.

In Q4, BBY forecasts revenue to be between $16.4 billion and $16.9 billion, while the consensus estimate is pegged at $16.7 billion. Similarly, comparable sales are expected to grow by -2% to 1% during the quarter.

For the full year fiscal 2022, BBY projects revenue to fall in the range of $51.8 billion to $52.3 billion, and comparable sales are expected to grow by 10.5% to 11.5% annually.

Shareholder Returns

During Q3, BBY repurchased $405 million worth of common stock and paid $172 million worth of common stock dividends.

The company’s Board also approved a quarterly common dividend of $0.70 per share, payable on January 4, 2022, to shareholders on record as of December 14, 2021.

Analysts’ View

In response to Best Buy’s modest quarterly performance, Wells Fargo analyst Zachary Fadem lowered the price target on the stock to $125 (3.3% upside potential) from $135, while maintaining a Hold rating.

Fadem said, “Considering elevated buy-side expectations, recent share outperformance, and a series of more punitive post-Q3 sell-offs, we can’t call today’s harsh -16% reaction a total surprise. BBY’s Q3 print was solid, with positive comps in every month (despite +33% Oct compare) and total comps of +1.6% nicely exceeding guidance. That said, investors anticipated higher percentage (low single-digit to mid-single-digit), and with November trends tracking flattish, and two-year stacks implied -10pts vs. Q3, our Q4/FY22 estimates are moving lower.”

The analyst concluded, “While execution has been strong and opportunities remain, our Equal Weight view is based on BBY’s heightened valuation and near-term concerns around investments and limited margin upside potential.”

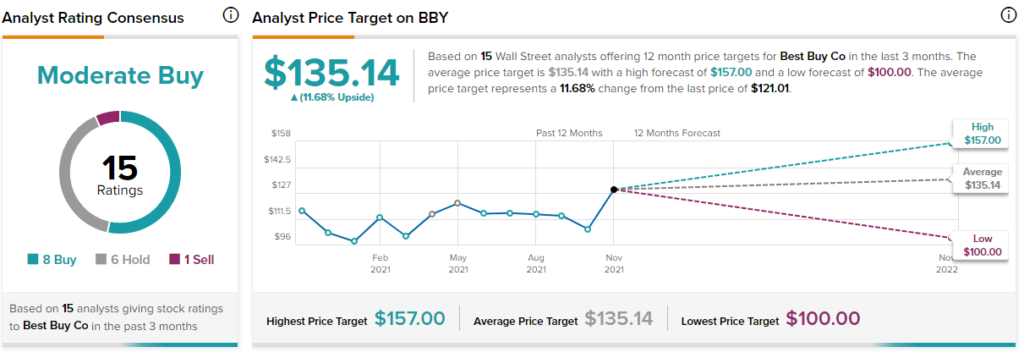

Overall, the stock has a Moderate Buy consensus rating based on 8 Buys, 6 Holds, and 1 Sell. The average Best Buy price target of $135.14 implies 11.68% upside potential to current levels. Shares have gained 6.6% over the past year.

Related News:

Best Black Friday Stocks

Zoom Drops 6.8% Despite Exceeding Q3 Expectations

Urban Outfitters Beats Q3 Estimates; Shares Slump 12%

Keysight Technologies Tops Q4 Results; Shares Fall