Warren Buffett’s decision to hold a staggering $325 billion in cash and short-term investments at Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) serves as a strategic fortress against the ongoing economic chaos. This massive cash position reflects Buffett’s cautious approach, likely driven by an overvalued stock market and, more critically, rising geopolitical risks, such as the tensions surrounding Taiwan between the U.S. and China.

By keeping such a hefty cash reserve, Buffett is positioning Berkshire Hathaway to weather potential market storms while staying nimble enough to seize opportunities when they arise. This is exactly why I’m bullish on Berkshire Hathaway — the firm is well-prepared to capitalize on any future shifts in the market.

Berkshire Hathaway’s Cash Position Is at a Record Level

I’m even more confident in my bullish stance after noticing that Berkshire Hathaway has been selling off significant portions of its equity holdings, including large stakes in Apple (AAPL) and Bank of America (BAC). So far in 2024, the firm has sold $133 billion worth of stocks while purchasing less than $6 billion.

This cautious approach makes perfect sense given that the total market cap of the Wilshire 5000 Total Market Index now exceeds twice the total U.S. GDP. Known as the Buffett Indicator, this suggests the market is at one of its highest valuations in history, reinforcing Buffett’s decision to remain liquid and patient.

Given Buffett’s impeccable track record, he is wise not to take on excessive risk toward the end of his tenure. From 1965 to 2023, Berkshire Hathaway achieved an annualized return of 19.8%, significantly outperforming the S&P 500’s (SPY) annualized return of 10.2% over the same period. As Buffett prepares CEO-in-waiting Greg Abel to take over, the last thing the company wants is to be heavily exposed to a stock market crash or, worse, a depression.

Buffett’s decision to hold so much cash (approximately 50% of his portfolio when including only public equities, or 30% when also including private companies and fully owned assets) is very prudent. This position allows his portfolio to continue growing if macroeconomic and geopolitical conditions remain stable, while also enabling him to capitalize on low valuations in the case of a significant market decline.

Buffett Takes Geopolitical Risks into Account

Buffett’s awareness of geopolitical risks is evident in his brief stake in Taiwan Semiconductor Manufacturing Company (TSM). This move reinforces my optimism about Berkshire Hathaway, as his quick exit amid rising tensions between China and Taiwan shows his ability to manage global risks. In Q3 2022, Berkshire Hathaway purchased a $4.1 billion stake in TSMC but sold 86% of it by Q4 2022 and fully exited the position by Q1 2023. He cited escalating tensions between China and Taiwan as the primary reason for the divestiture.

Despite selling TSMC due to geopolitical risks, Buffett retained and even increased Berkshire’s investment in Apple, TSMC’s largest customer. Critics have noted that Apple’s reliance on TSMC for chip production exposes it to similar risks. A hot war surrounding Taiwan would likely cause a global depression, according to Bloomberg.

Therefore, it makes sense that Buffett not only exited TSMC but has also gradually been increasing Berkshire’s cash position to mitigate the broader risks presented by an authoritarian China claiming ownership of Taiwan, even though it has operated as an independent democracy since 1949.

Risk-Neutral Portfolio Modeling Is Crucial Right Now

While I have a positive outlook on Berkshire Hathaway, I also focus on my own portfolio modeling. I’ve been constructing a primary risk-neutral portfolio and a smaller subset equity growth portfolio. The ratio of this model is approximately 5:1, neutral versus growth, respectively. This approach provides an ability to maintain equity growth while preserving capital in the event of an economic crisis, which I currently consider a moderate risk.

While Berkshire has trimmed major positions substantially to improve liquidity, Buffett has selectively added consumer-centric stocks like Domino’s Pizza (DPZ) and Pool Corp (POOL), reflecting a focus on resilient businesses with strong fundamentals over intangible value and outsized growth.

In my opinion, a risk-neutral portfolio holding about 50% in short-term U.S. Treasuries, 12.5% in gold (CM:XAUUSD), and 37.5% in fundamentally-oriented, well-valued equities should provide sufficient resilience in a worst-case scenario. When balanced with an equity growth portfolio consisting of 100% high-alpha opportunities, this approach provides both stability and opportunity.

Berkshire Hathaway Is Currently Moderately Overvalued

I’m bullish on Berkshire Hathaway, even though it appears moderately overvalued at the moment, with a forward price-to-book ratio 10.5% higher than its five-year average. To the contrary, its trailing 12-month price-to-book ratio is over 70% lower than its five-year average, indicating that the stock could still be attractive at its current price.

Given that Berkshire Hathaway has a $325 billion cash pile, the company is well-protected against any drawdown in valuation that may occur in the coming years due to macroeconomic factors. While I prefer to model my own portfolio, owning Berkshire Hathaway alone could also provide a suitable balance between risk mitigation and capital appreciation.

Is Berkshire Hathaway B Stock a Buy, Sell, or Hold?

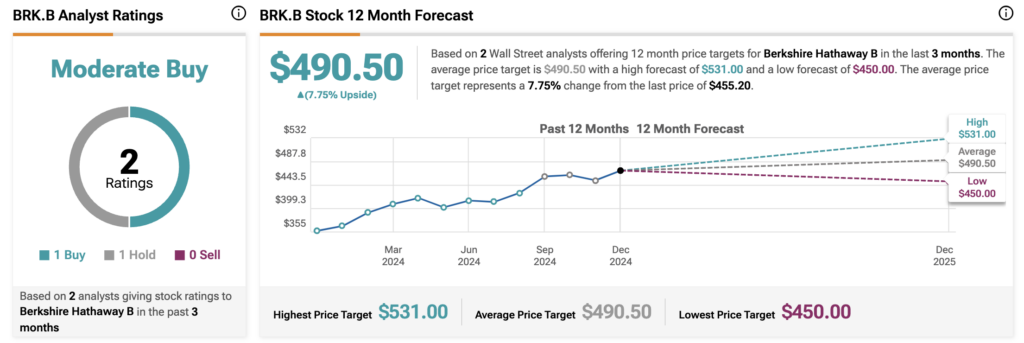

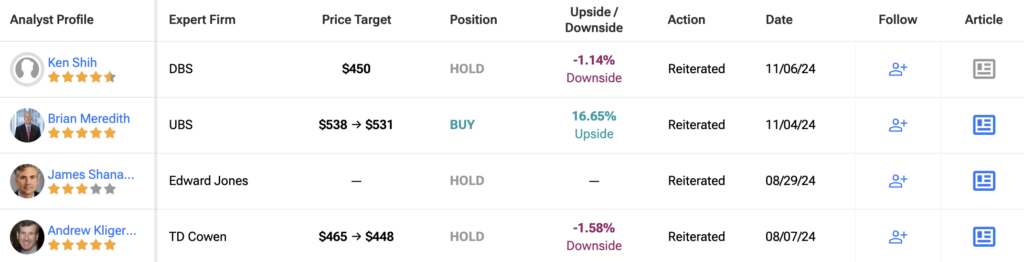

On Wall Street, Berkshire Hathaway has a consensus Moderate Buy rating, based on one Buy, one Hold, and zero Sells. The average BRK.B price target of $490.50 indicates a 7.8% upside potential over the next 12 months. While this implies only moderate growth expectations, it also suggests a high probability of stability in the company’s valuation.

See more BRK.B analyst ratings

Conclusion: Berkshire Hathaway Is a Buy amid Macroeconomic Uncertainties

As the general U.S. market is clearly overvalued based on its market cap compared to gross domestic product, and as geopolitical instabilities have the potential to intensify, acting as a catalyst for a market decline, Berkshire Hathaway is worth considering. Buffett’s strategy of holding significant cash reserves is wise. Although the 7% potential upside over the next 12 months is modest, the security against outsized losses is invaluable.