Warren Buffett’s investment conglomerate Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) reported its third quarter Fiscal 2023 results on November 4. The company posted a huge quarterly net loss of $12.77 billion, much higher than the $2.8 billion loss registered in the prior year quarter. However, its operating income boosted by 40.6% year-over-year to $10.76 billion. At the same time, BRK’s cash balance jumped to a record high of $157.2 billion, up roughly $10 billion from the second quarter. Equity securities seem to be fading in appeal as Buffett sold over $5 billion worth of shares during Q3 and diverted the funds to high-yielding short-term assets.

Meanwhile, Berkshire Hathaway’s investment losses from equity securities grew to $24.1 billion, largely due to an 11.7% drop in Apple’s (NASDAQ:AAPL) stock. The Oracle of Omaha has steadily grown the firm’s investment in Apple shares to approximately 50% of the total portfolio. The share price drop reflected a nearly $20 billion loss on the company’s investment portfolio. Even so, Buffett continues to believe that investment gains/losses are just on paper and shareholders must not pay much heed to them.

Berkshire’s focus on cash stemmed from his belief that Treasury yields would surely shoot up in a high-interest rate scenario. And rightly so, BRK.A has some $126.4 billion tied up in short-term bonds, which have generated a nearly 5% yield during the quarter. Importantly, Buffett reduced the firm’s share buyback activities. In Q3, the firm repurchased shares worth $1.1 billion, totaling $7 billion for the year-to-date period.

Is Berkshire Hathaway B Stock a Good Buy?

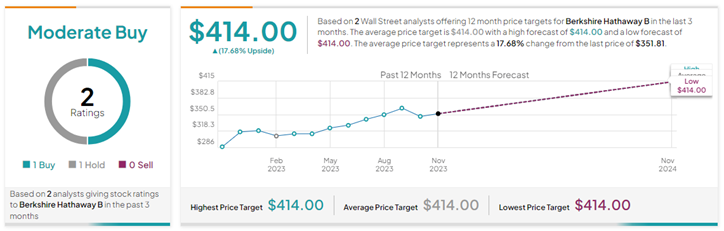

With one Buy versus one Hold rating, BRK.B stock has a Moderate Buy consensus rating on TipRanks. Importantly, these ratings were given before the Q3 results were announced and could change analysts’ views. The average Berkshire Hathaway B price target of $414 implies 17.7% upside potential from current levels. BRK.B stock has gained 13.5% so far this year.